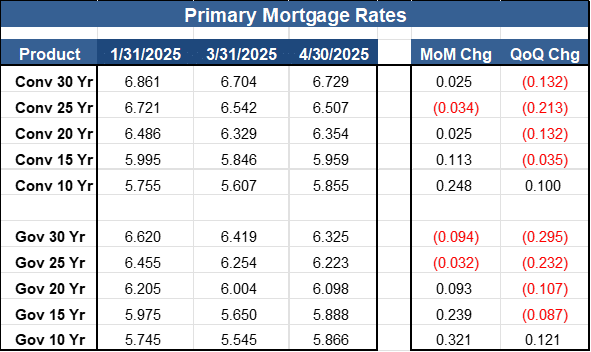

Mortgage rates continued their moderate volatility during the month of April. MCT’s mortgage rates model reflected a slight increase in mortgage rates of about two (2) basis points, on average. MCT’s current primary 30-year fixed rate closed the month at 6.72%. Current mortgage rates levels reflect uncertainties within the macro-economic picture as recession fears are more relevant than during Q1, 2025.

The labor market remained strong in April, and cooling inflation figures from March might have incented the Fed to lower rates in May. However, the broadly utilized tariffs are posing a threat to inflation and should prevent the Fed from taking any action in May.

MSR values, so far into 2025, have held steady and are reflecting a resilient MSR market in the face of several uncertainties. Many servicers have posted losses at the end of Q1, 2025, however, MSR values and persistent demand for MSR are reducing their fears of any potential future risks. If necessary, companies can sell off their MSRs at a premium price, to offset any financial losses.

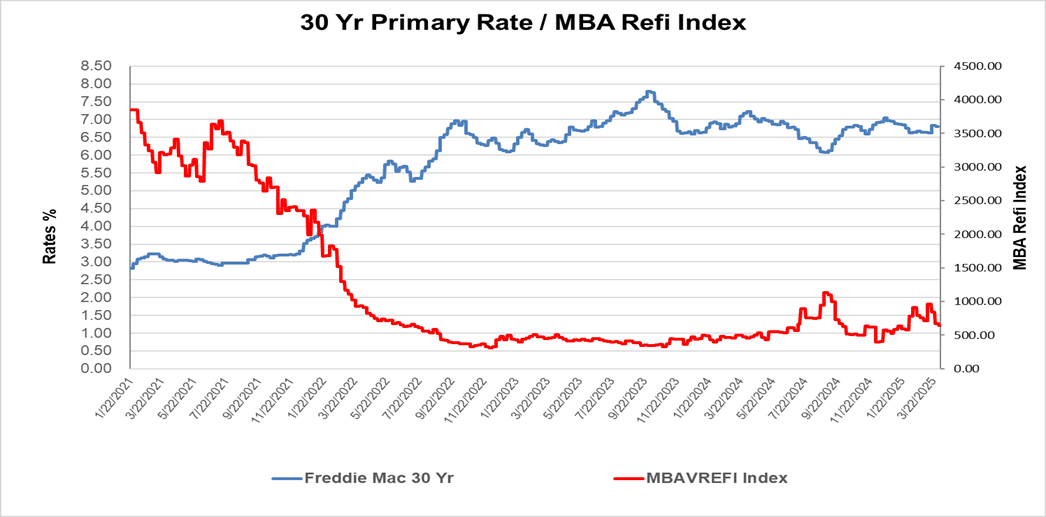

Loan production volume remained relatively weak during the month of April. MCT continues to observe an increase in mortgage applications when mortgage rates dip below 6.75%. Recent trends did reflect borrowers’ demand for loans even with the slightest drop in mortgage rates. However, we do not anticipate a refinancing boom on the horizon. Although, MCT anticipates a periodic uptick in prepayments as borrowers take advantage of those occasional mortgage rates declines.

Mortgage delinquencies continue their upward trend as borrowers continue to struggle with their rising debt and higher property taxes and insurance. More borrowers are falling behind on their mortgage payments, particularly within the 90+ days delinquency category. Despite this upward trend, overall delinquencies generally remain in line with acceptable historical levels.

New Production Value Trends:

Property tax and home insurance costs are making it more difficult for borrowers to qualify for mortgage loans. This phenomenon is weighing heavily on the middle class and low-income borrowers. Current monthly escrow payments make up about 20-25% of the total monthly mortgage payment. This increase represents about a 200%-300% rise since 2021.

While high monthly escrow payments will benefit MSR values, it adds additional financial pressure that could lead to potentially higher mortgage delinquencies.

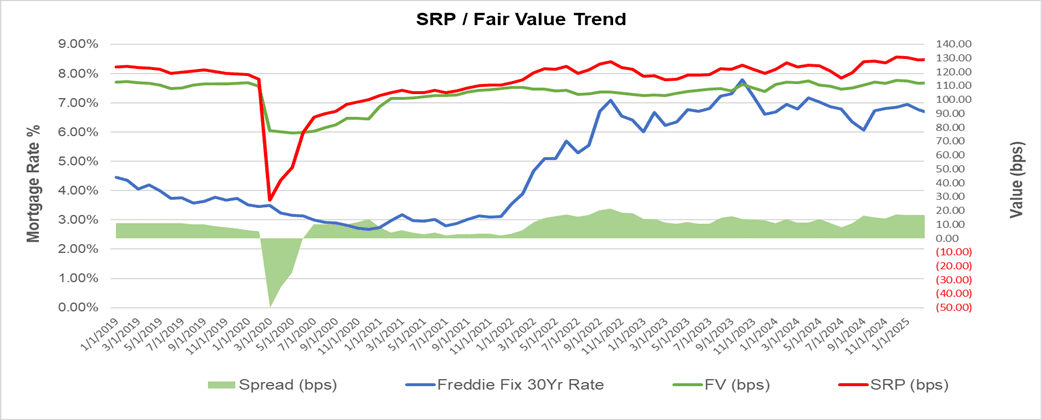

Recent servicing release premiums (SRP) remain very strong due to low new loan production volume. The SRP prices remain very attractive and offer much-needed financial relief for many lenders. Many lenders with servicing portfolios are challenged to determine which mortgage loans they should retain or release. It requires a balancing act to prevent their fee income from eroding while benefiting from the attractive SRP prices. Our estimates point to the 25% - 35% retention level to simply maintain level servicing income.

SRP values continue to be about 10-15 basis points higher than fair values, though, that spread has leveled off during Q1, 2025. We expect the trend to continue for the foreseeable future. We continue to advocate caution when capitalizing new MSR production at moderate price levels as the market navigates current mortgage rates uncertainties.

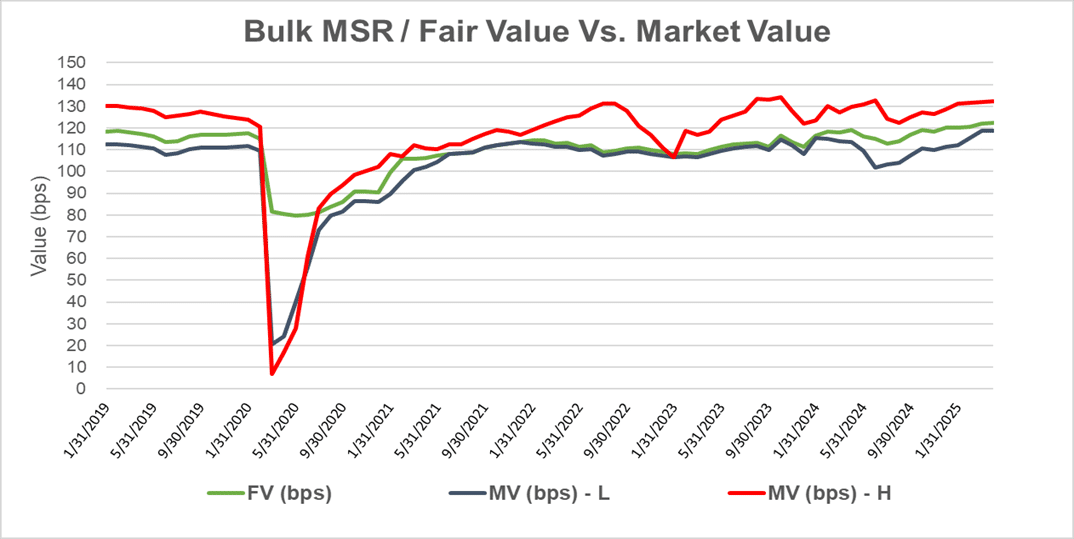

Bulk MSR Market

Auctioned Bulk MSR activity has been muted since Q1, 2025. Mortgage rates and Treasury yield curve volatility during April led many buyers to remain on the sidelines while determining their next steps. Although that market dynamic did not stop some buyers from paying premium prices for available MSR offerings during the month of April.

Bulk price levels remained robust and attractive for many buyers and sellers alike. A few bulk MSR trades ranged between 130 to 139 basis points (5.20 – 5.56 multiple of servicing fees). One particular MSR portfolio that was recently acquired by JPMorgan Chase from United Wholesale Mortgage at 6.50 multiple of servicing fees. This acquisition is more of an anomaly rather than the norm. However, with the continuous low mortgage production volume, we could see more of such price levels.

MCT anticipates that bulk MSR trading activities will remain low to moderate levels due to the many uncertainties tied to mortgage rates and other macro-economic factors. However, premium prices and demand for MSR could alter the landscape.

Non-QM and Second Mortgages Trends

Investors’ demand for Non-QM and second mortgage originations remains strong, and production volume has recovered a bit since mid Q1, 2025. However, Investors are cautious with their pricing of Non-QM and closed end second mortgage originations prices.

MCT observed a slight increase in prepayments and delinquencies during the months of March and April, particularly with higher interest rate bands.

The bulk MSR market for these two segments is very low and almost nonexistent, except for some direct transactions between buyers and sellers. Underlying fair values for Non-QM MSR products’ fair values remain between 3.70 – 4.30 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30x and 3.25x multiples of servicing fees.

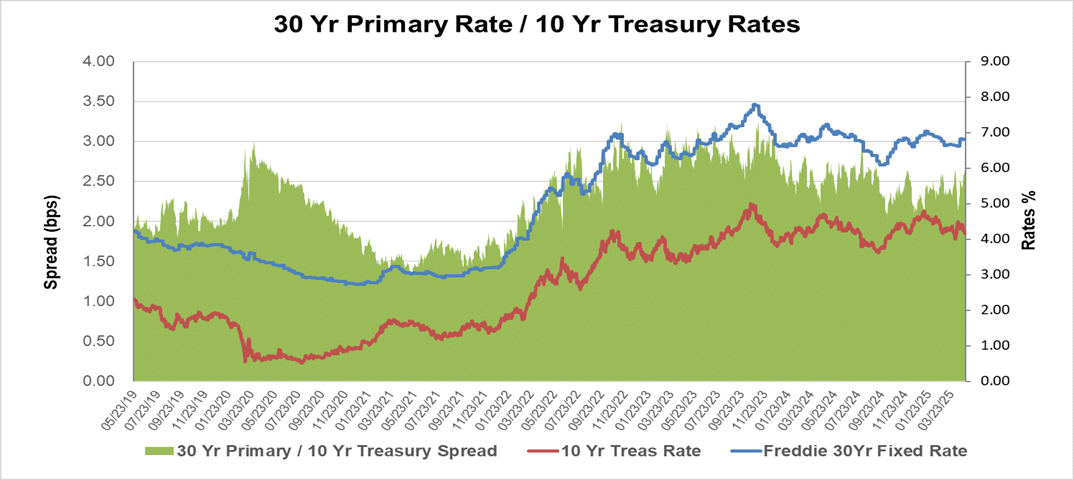

Mortgage Rates

As of April 30, 2025, the current fixed 30 Year mortgage rate is 6.7292%, which represents about two (2) basis points increase from March 31, 2025, mark.

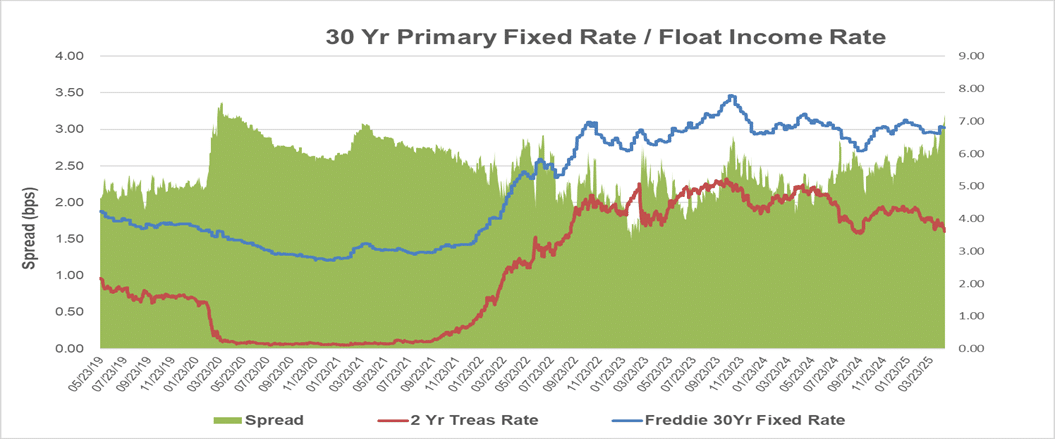

Escrows and Float Income

Mortgage escrow values are under pressure due to volatility in the short-term rates that the rate markets have experienced during the month of April. Most of the MSR value declines we anticipate with April 30, 2025, valuations are attributed to the decline in float income rates which were about 18-25 basis points.

Escrows’ value is the second largest contributor to the overall MSR value. With the recent volatility within the short-term rates, escrow float income could potentially have a significant impact on the MSRs overall values. However, rising monthly escrow payments could potentially offset the decline in values associated with the decline in float income rates.

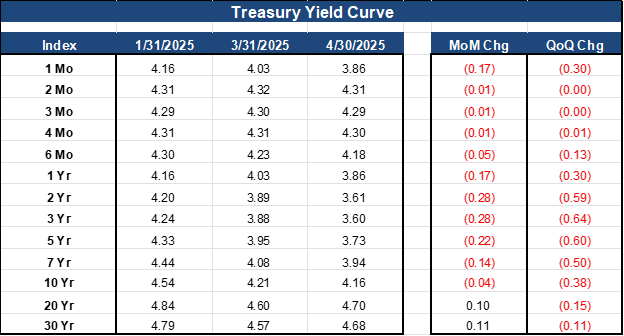

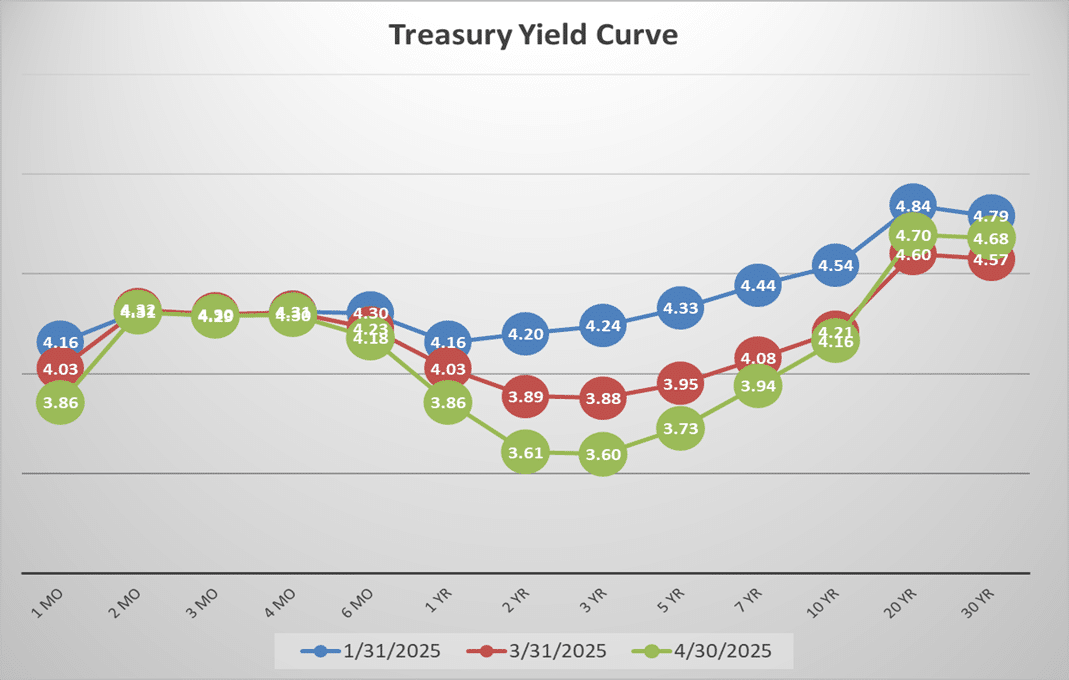

Rates Indices

The current Treasury yield Curve is reflecting some economic distress and future economic uncertainties. The new administration policies are creating some anxieties among investors as they try to determine what lies ahead.

Most rate indices have declined month over month, particularly the long term indices.

The current spread between the 2 Yr Treasury rate and the 10 Yr Treasury rate is on a trajectory that is similar to the time immediately after the pandemic, which could signal that some economic challenges are ahead. Many economists are now predicting about 80%-90% possibility of a recession during 2025.

Fair Value Guidance

Our estimate of the fair values for existing portfolios should remain relatively stable, but somewhat lower than their March 31, 2025, marks. Changes in MSR values will be dependent on the percentage of escrowed loans in addition to the amount of monthly escrow payments that are collected. The slight increase in mortgage rates was offset by the sharp decline in float income rates (18 basis points).

MSR holders should expect a decline in fair values ranging from 1 to 4 basis points, primarily due the decline in float income rates.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between -1 to -2 bps change from March 31, 2025, marks.

- Government loans between -1 to -4 bps change from March 31, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net