Mixed economic signals are causing many economists to remain cautious, even as U.S economic growth rebounded to 3.0 percent in Q2 after a Q1 contraction. The full effects of the tariffs loom large and are yet to fully materialize.

Home price appreciation is slowing nationally, with the latest data showing the weakest annualized gains since 2023. However, regional home price appreciation varies from state to state as some states show rising home prices while others like in Florida, are showing price declines.

July’s consumer data reflects slight optimism about the economy, but household spending reflects some hesitation in spending. Tariff fears and a steady moderation in the labor market continue to leave consumers less confident in their job prospects which could limit their willingness and ability to spend.

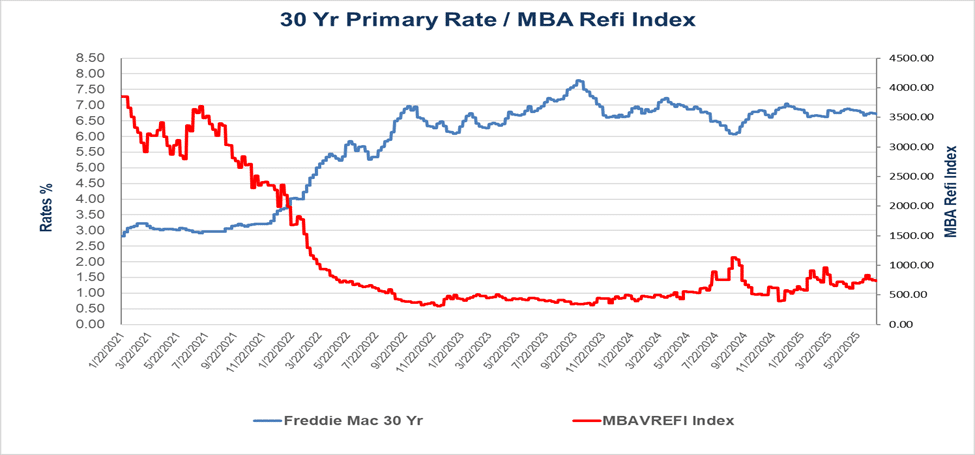

According to the latest MBA forecast, the average interest rate for a 30-year fixed-rate mortgage is expected to decline from 6.80% in Q2, 2025 to 6.60% in Q2, 2026.

The housing market is facing continued challenges facing home buyers and sellers as both new and existing home sales were below expectations. Economic uncertainty and affordability issues due to high prices and relatively high interest rates weighed on home sales and new construction. New data released in July show that existing home sales declined to a ten-month low (3.93 mm units) while the average sale price climbed to $435,000.

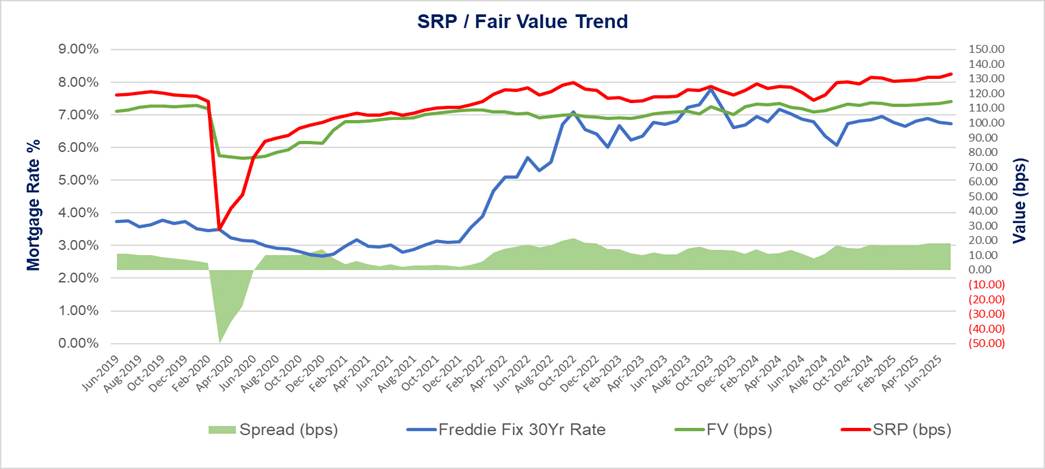

New Production Value Trends:

Affordability concerns and relatively high mortgage interest rates continue to weigh on the current home buying season that is already in full swing. Many potential buyers are opting to wait on the sideline hoping for better future opportunities.

July’s mortgage production levels reflect a moderate increase over June levels. Refinancing activities continue to reflect a somewhat promising upward trend. As the real estate market enters the second half of the home buying season, there are signs of hope that potential home buyers will eventually opt to make their purchases as mortgage rates show no signs of easing.

The current average SRP price is now about 15-25 basis points higher than the average fair value. Many lenders with servicing portfolios are faced with tough choices related to retaining some of their loan production or selling their loan production on a servicing released basis. We continue to advocate for caution when capitalizing new MSR production at moderate levels as current SRP levels in the market reflect the aggregators economies of scale rather than actual fair value.

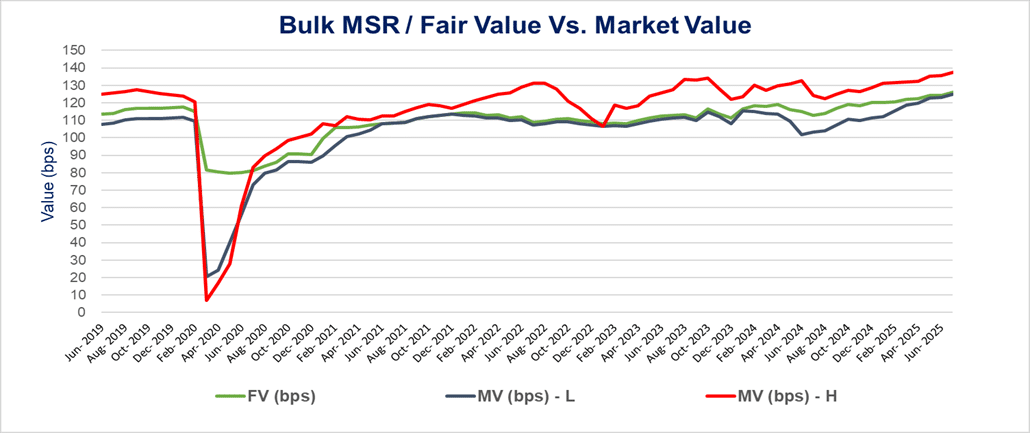

Bulk MSR Market

July was a moderate month in terms of bulk MSR trades; However, prices paid for bulk MSR portfolios continue to exceed expectations. Low mortgage production volume, higher mortgage rates and float income rates led to higher price offerings for bulk MSR packages.

Bulk MSR trades ranged between 135 to 144 basis points (5.40 – 5.76 multiple of servicing fees). Demand for bulk MSR portfolios has never been so high and is reflected in the prices paid for any MSR portfolio brought to market.

Non-QM and Second Mortgages Trends

Non-QM production continues to increase month over month as more investors seek opportunities within this segment. Investor interest in non-QM is beyond depository institutions and has extended beyond traditional financial institutions. Expected yields and returns on investment of non-QM products are naturally higher than conforming agency loans.

Delinquencies, just as in conforming loans, are slowly rising, particularly within higher interest rate ranges. July prepayments reflected a slight increase over June prepayment levels as borrowers seek opportunities for better mortgage rates from competing lenders.

HELOCs and closed end second mortgage lenders continue to see their fortunes improve as demand for such products increases from borrowers with significant home equity and low first mortgage rates. The market should experience a strong Q3 in terms of total loan production.

The bulk MSR market for these two segments remains low. Underlying fair values for non-QM MSR products remain between 3.65 – 4.40 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30x and 3.25x multiples of servicing fees.

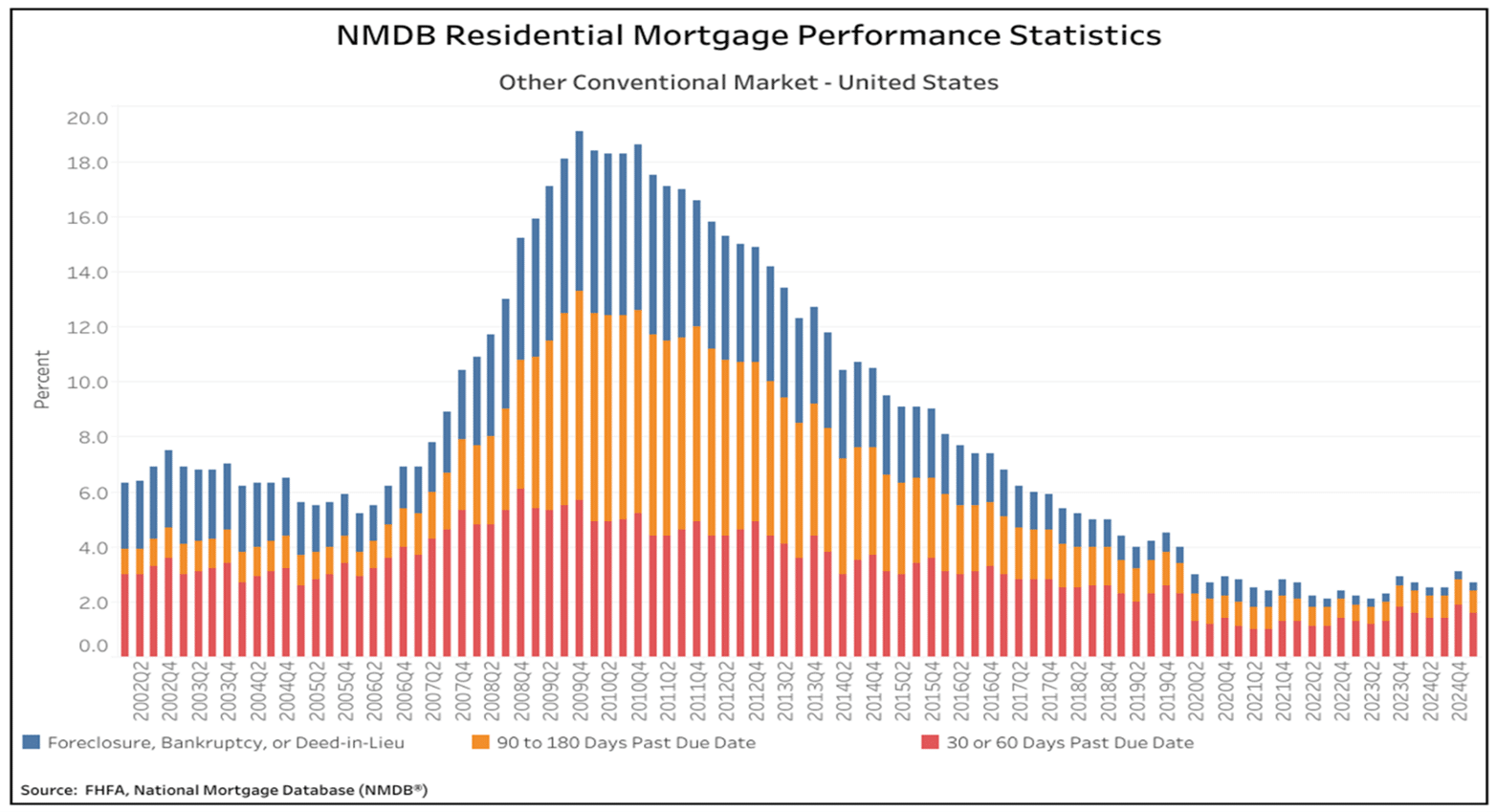

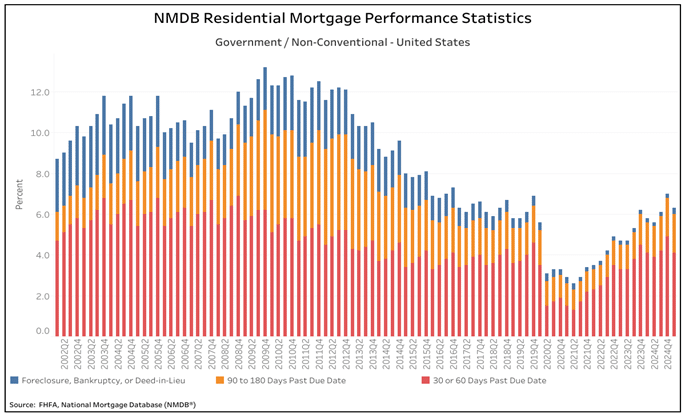

Mortgage Servicing Performance

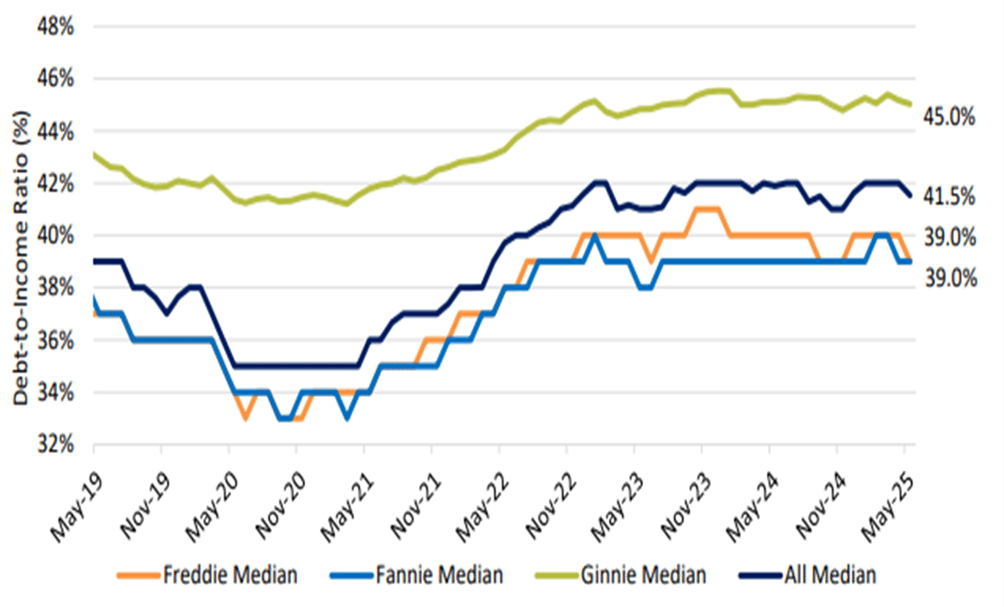

Mortgage servicing performance remains stable and under control. However, there are signs that indicate that mortgage borrowers are under increasing financial stress; As consumer debt continues to rise at about $500 MM per year, the debt-to-income ratio is rising along with it. Current DTI ratios are about 20% higher than pre-Covid-19 levels.

Additionally, existing mortgage borrowers are confronted with continuous and rising property taxes and hazard insurance premiums; Current monthly escrow payments amount to about 30 percent of the total borrowers’ mortgage payment compared to about 15 percent in 2022. This is double the amount of escrow payments since 2022, and in some states, it is even higher than that

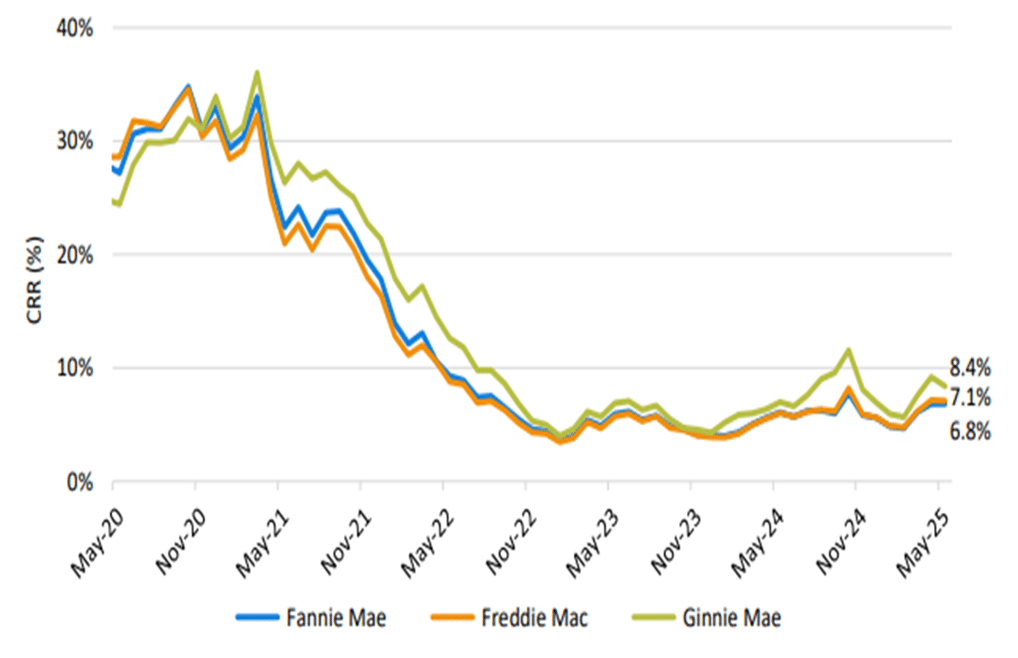

Current voluntary prepayment speed remains in the high single digits, however, we anticipate that prepayment levels will increase to double digits if and when mortgage rates decline below 6.50%. Similar to what the industry experienced towards the end of Q3, 2024 when mortgage rates were around 6.375% for a brief period of time.

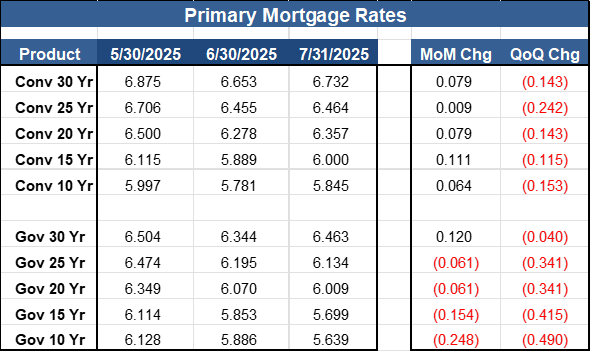

Mortgage Rates

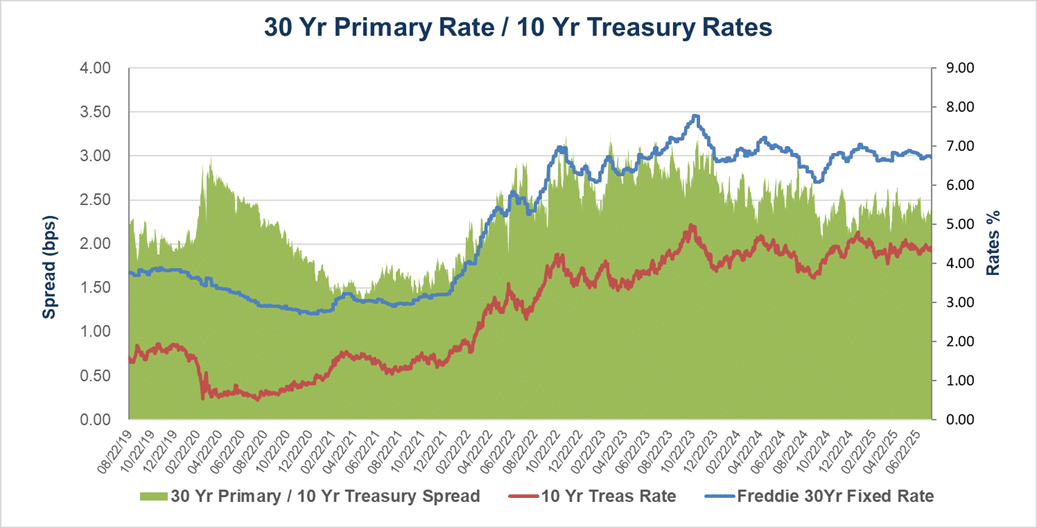

As of July 31, 2025, the current fixed 30 Year mortgage rate is 6.731%, which represents about eight (8) basis points increase from June 30, 2025, mark.

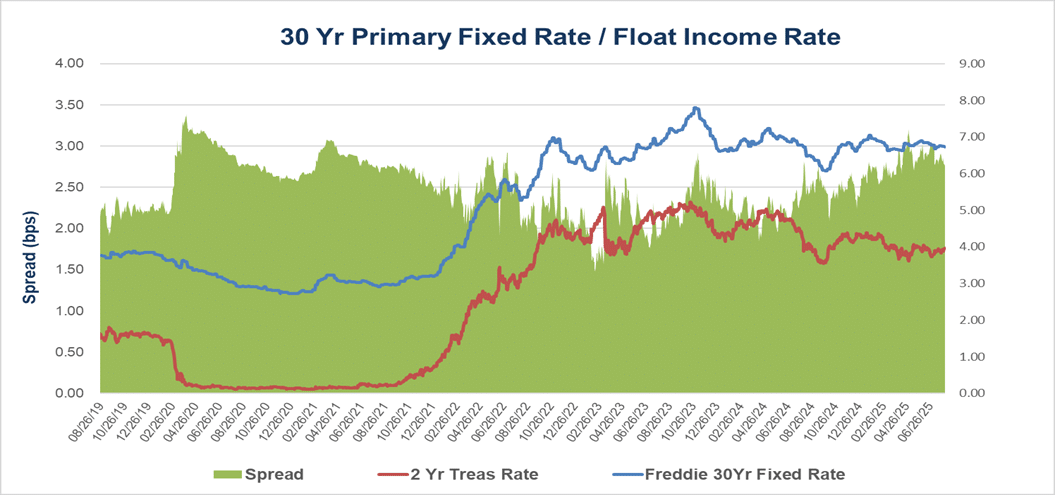

Escrows and Float Income

Mortgage escrow values have recovered from June 30, 2025, marks due to the sharp increase in float income rates, which rose by about 14 to 23 basis points during the month of July 2025. This increase in float income rates has improved the overall value of MSR portfolios. Escrows’ value is the second largest contributor to the overall MSR value.

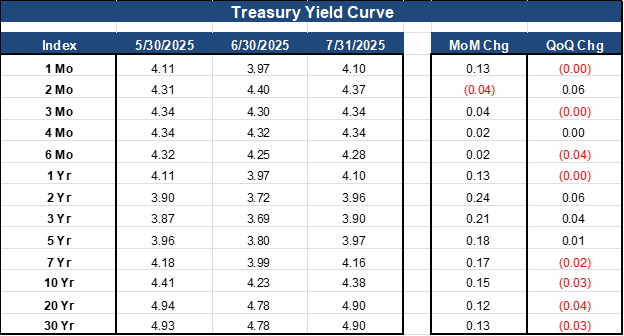

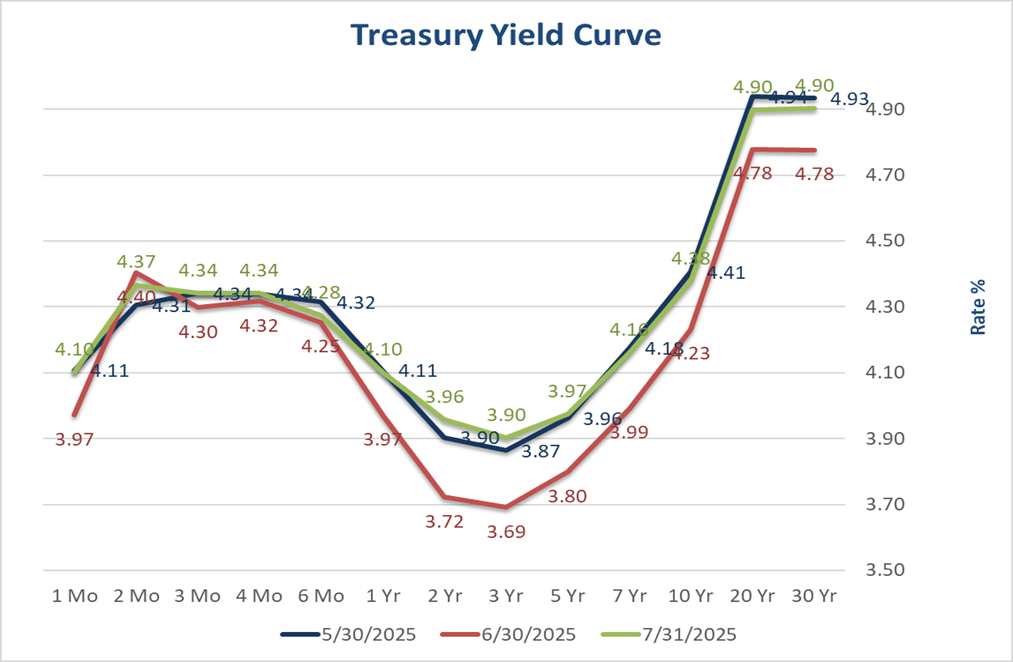

Rates Indices

Current mortgage rates remained stable during the month of July 2025, closing the month at a higher rate than June 30, 2025, marks. Mortgage rates have increased by an average of eight basis points since June 30, 2025.

The yield on the benchmark 10-year Treasury is at 4.10%, 13 basis points higher than prior month, and in-line with May’s mark.

Fair Value Guidance

Our July 31, 2025, fair values estimate for existing portfolios should increase from June 30, 2025, marks. Changes in MSR values will be dependent on the level of percentage of escrowed loans and the amount of monthly escrow payments that are collected due to the significant increase in float income rates. The increase in mortgage rates will reduce the prepayment forecast, which will have a positive overall impact on fair values.

MSR holders should expect an increase in fair values ranging from one (1) to three (3) basis points, primarily because of the increases in mortgage and float income rates.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between +1 to +2 bps change from June 30, 2025, marks.

- Government loans between +1 to +3 bps change from June 30, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net