MCTlive! Release Notes – Q4 2024

Published 01/22/2025

Welcome to MCT’s Quarterly Release Notes!

Described below within relevant tabs, you’ll find a listing of our Q4 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development.

As a company, MCT consistently seeks to expand communication and transparency with our clients and partners. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

- Alternate Credit Scores – MCTlive! now has the ability to consume an alternate credit, like the FICO 10T score, and share the score on the bid tape.

- Commitment Tracker Filtering – The commitment tracker tab in MCTlive! now has the ability to filter by Loan Number, Borrower Name, and Program Name. [View Screenshot]

- Committed Volume Report to Agencies – The Agency Rapid Commit tab now includes the total Commitment Activity for each agency per date selected. [View Screenshot]

- Hedge Adviser View Update – The Hedge Adviser tab in MCTlive! now includes an option to view PT Adjusted Volume. [View Video]

- MFA Enhancements – Updated MFA structure to improve user functionality among different applications.

- Pipeline Activity Summary New Production – Pipeline Activity Summary New Production now includes pull through adjusted loan amount. [View Screenshot]

- Pipeline Deltas – Sold Data Attributes to Initial Lock Attributes – A user now has the ability to easily compare loan attributes from a sold loan to its initial lock. [View Screenshot]

- Trades – MCTlive! now has the ability to log a Buy Side Trade. [View Screenshot]

- Training Center – The Training Center now includes links to MCT Whitepapers. [View Screenshot]

- Training Center – The Training Center now includes links to the MCT Blog. [View Screenshot]

- Updates to Training Center – A user can now find links to MCT webinars in the Training Center. [View Screenshot]

- Alternate Credit Scores – MCTlive! now has the ability to consume an alternate credit, like the FICO 10T score, and share the score on the bid tape.

- Attribute Restriction Add – Users now have the ability to build a rule around the attribute AMI. [View Screenshot]

- Best Ex Analysis – The Best Ex Analysis Attribute Restrictions now includes Amortization Term. [View Screenshot]

- Best Ex Analysis – The Best Ex Analysis Attribute Restrictions now includes 2nd Lien Type. [View Screenshot]

- Best Ex Summary and Weighted Average FICO – The Best Ex Summary on the Best Ex analysis page will now display the weighted average FICO. [View Screenshot]

- Bid Tape Posting Enhancement – The feature streamlines posting process after uploading loan numbers.

- MCT Marketplace Tape – The MCT Marketplace tape now shows Self Employed in column BM instead of Employment Type. The values in this column will be Y or N based on the normalized raw data.

- Rapid Commit – The Rapid Commit screen now includes the ability to override all HB to conforming programs for committing purposes. [View Screenshot]

- Saving a Best Ex Now Generates Email – Saving a best ex now generates an automated email to a defined group of users.

- Sorting Features in BAM AOT Trade Section – Sorting Features now available in the BAM AOT Trade Selection. [View Screenshot]

- Active User Report – The Active User Report now includes First and Last name of the listed users.

- Mission Score Report for Committed Production – New Mission Score report for the last 30 days of committed production.

- Trade Reporting – New Trades Reports have been created to display a trade channel on the reports.

Business Intelligence Updates

- Spec Composition View – Located within the Lock Volume project, this new dashboard allows clients to see what percentage of their open hedged pipeline is composed of spec products. This complements the new MCTlive! release of the ability to customize hedge performance with spec durations. [View Screenshot]

- Added Hyperlink to Investor Portal for Marketplace Investors – Sellers now have easy access to the Investor Portal by selecting the Get More Info button located in the Shadow Bid Performance table of best ex analysis. Selecting this button will direct sellers to the Investor Portal page where they will find additional information about the prospective investor.

- MCT Marketplace Tape – The MCT Marketplace tape now shows Self Employed in column BM instead of Employment Type. The values in this column will be Y or N based on the normalized raw data.

- Update Investor Names to Better Highlight Shadow Bids – In an effort to provide greater transparency into lenders’ approval status with their list of investors, all unapproved Marketplace investors in the investor update table of the best ex analysis tab will be listed with “Shadow” after their name.

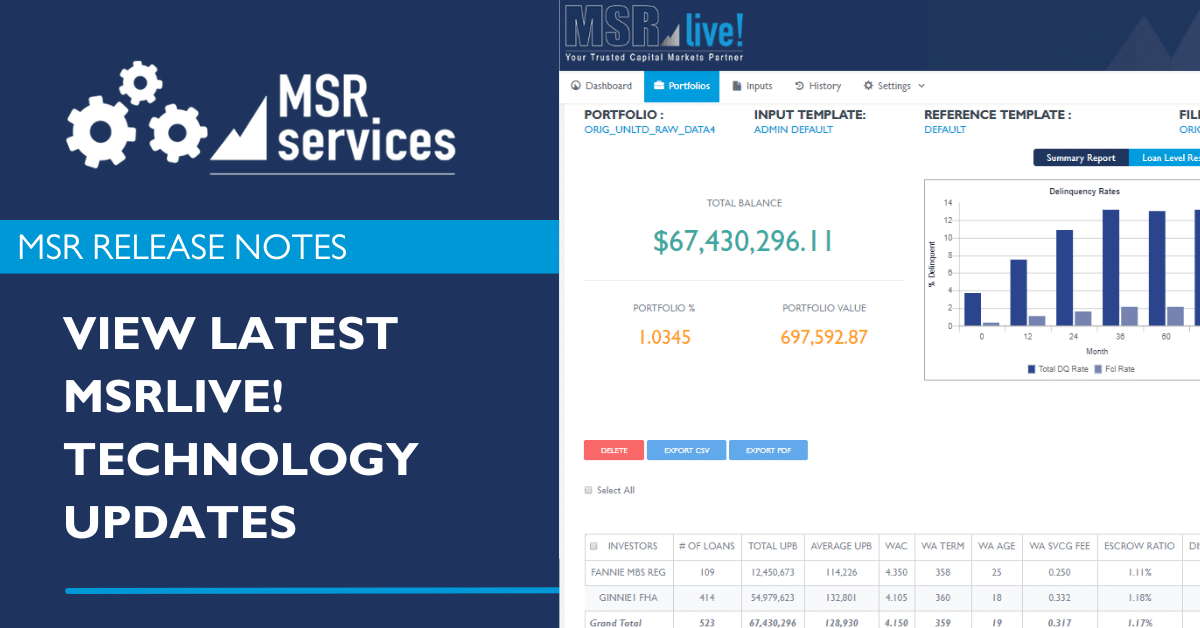

MSRlive! Release Notes

In addition to providing quarterly MCTlive! Release Notes, MCT’s MSR team also provides technology updates and release notes for users of the platforms. View the most recent MSRlive! releases below.

MCT’s MSR division will continue to produce monthly release notes specific to MSRlive!. MSRlive! is a robust mortgage servicing rights valuation tool used to manage servicing portfolios.

“From October through December 2024, twenty-seven enhancements to MCTlive! were released to improve execution, efficiency, and experience for clients.”

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

About the Author:

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

Steve Pawlowski contributes over three decades of expertise in mortgage and capital markets space to MCT. Steve is a strategic and highly accomplished Transformation Executive with a progressive record of success leveraging analytical capabilities, an entrepreneurial mindset, and innovative thinking to drive emerging technology advancements through process improvements and new business development.

Before joining MCT, Steve was the Senior Vice President and Head of Single-Family Products & Solutions, overseeing the design, development, and integration of Single-Family’s digital products and services across the residential mortgage loan life cycle. He was also responsible for fostering the integration of Fannie Mae’s technology and business infrastructure with its clients, facilitating their growth and value creation within the market landscape.

Prior to this, Steve served as the Senior Vice President and Head of the Capital Markets Journey in Single-Family, steering the development of products for the conduit and capital markets sector. He was responsible for the provision of execution tools, business solutions, and services, employing customer engagement, design thinking, innovation, and agile methodologies to deliver exceptional outcomes.