MCTlive! Release Notes – Q2 2025

Published 7/30/25

Welcome to MCT’s Quarterly Release Notes!

Described below within relevant tabs, you’ll find a listing of our Q2 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Data & Analytics tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development.

As a company, MCT consistently seeks to expand communication and transparency with our clients and partners. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

- Commitment Tracker Sorting – New sorting functionality is now available in the Commitment Tracker. [View Screenshot]

- Commitment Tracker Update – Loan AUS is now available on Commitment Tracker. [View Screenshot]

- Modify Trades – Trade Channel is now available as an editable field when modifying a trade. [View Video]

- Trade Filtering – Users are now able to filter the MCTlive! trade blotter by trade number. [View Video]

- Best Efforts No Price Locks Report – This new Best Efforts Lock Report will show open Best Efforts locks or Funded Best Efforts locks that have not been purchased where the net sell price is less than 50. An additional report with the same filtering showing the attributes of the loan is also now available. [View Sample Report]

- New Executive Summary Reporting Available – New executive summary reports are now available to account for lenders utilizing the 4th month TBA as well as future settlement dates. [View Screenshot]

- New Reports with Custom Fields – The reports suite in MCTlive! now includes Custom Fields that can be mapped from the client’s pipeline data feed. The Custom Fields are now accessible when creating a Committed, Fallout, or Purchased report.

- Committed Held for Sale – A new report showing the loan attributes is now available.

- Best Efforts New Locks Report – A new Best Efforts report showing only new locks is now available. An additional new locks report showing the loan attributes is also available. [View Sample Report]

- Committed Held for Sale Report – Users can now access a Committed Held for Sale Report that includes Discount Points, Lender Credits, and Lender Fees constructed as a borrower price and compared to the Net Sell Price. [View Sample Report]

- Best Efforts Held for Sale Report – Users can now access a new Best Efforts Held for Sale Report that includes Discount Points, Lender Credits, and Lender Fees constructed as a borrower price. [View Sample Report]

- Custom Raw Data fields in MTM Reports – We have increased the number of raw data fields that can be added to MTM reports from a maximum of 4 to 20. The column heads have also been updated to reflect raw data column headers instead of column letters. [View Screenshot]

- Update to Scenario Pricer – Users are now able to easily find the product you need to run your scenario. [View Screenshot]

- New AOT Savings Workbook – A new AOT Savings workbook is now available. It includes peer comparisons on historical savings from AOT executions and a graph visualization. [View Sample Report]

- Purchase Price Variance Loan Detail – A new slider is now available in the Purchase Price Variance Loan Detail view, allowing the user to filter down the loans where sell and purchase prices are greater than your set filter. [View Screenshot]

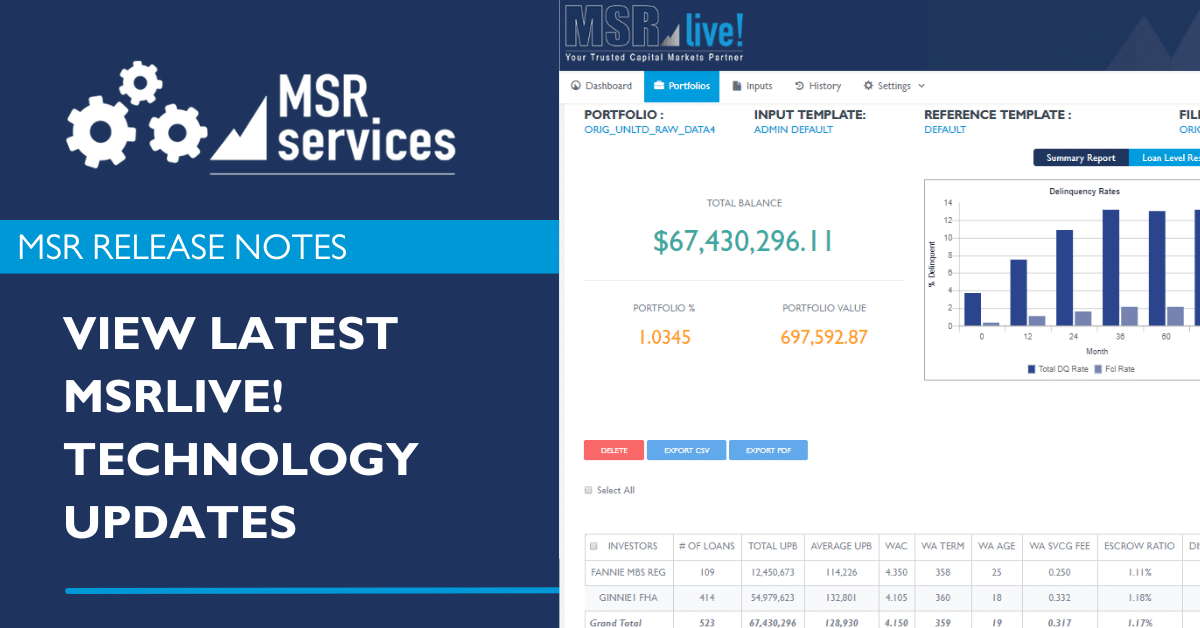

MSRlive! Release Notes

In addition to providing quarterly MCTlive! Release Notes, MCT’s MSR team also provides technology updates and release notes for users of the platforms. View the most recent MSRlive! releases below.

MCT’s MSR division will continue to produce monthly release notes specific to MSRlive!. MSRlive! is a robust mortgage servicing rights valuation tool used to manage servicing portfolios.

“From April through June 2025, thirteen enhancements to MCTlive! were released to improve execution, efficiency, and experience for clients.”

About the Author:

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

Steve Pawlowski contributes over three decades of expertise in mortgage and capital markets space to MCT. Steve is a strategic and highly accomplished Transformation Executive with a progressive record of success leveraging analytical capabilities, an entrepreneurial mindset, and innovative thinking to drive emerging technology advancements through process improvements and new business development.

Before joining MCT, Steve was the Senior Vice President and Head of Single-Family Products & Solutions, overseeing the design, development, and integration of Single-Family’s digital products and services across the residential mortgage loan life cycle. He was also responsible for fostering the integration of Fannie Mae’s technology and business infrastructure with its clients, facilitating their growth and value creation within the market landscape.

Prior to this, Steve served as the Senior Vice President and Head of the Capital Markets Journey in Single-Family, steering the development of products for the conduit and capital markets sector. He was responsible for the provision of execution tools, business solutions, and services, employing customer engagement, design thinking, innovation, and agile methodologies to deliver exceptional outcomes.