MCTlive! Release Notes – Q1 2025

Published 04/25/2025

Welcome to MCT’s Quarterly Release Notes!

Described below within relevant tabs, you’ll find a listing of our Q1 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development.

As a company, MCT consistently seeks to expand communication and transparency with our clients and partners. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

Key Quarterly Update – New Fields Now Available in MCTlive!

We’re excited to announce the release of 28 new data fields now available in our residential mortgage dataset. These additions are designed to give our clients even deeper insight and flexibility in hedge analysis and loan sale strategies.

Several of the new fields are specifically tailored to support the growing market for non-agency loan products, including Non-QM, helping lenders better prepare their loan pools for a broader array of secondary market execution options.

Whether you’re optimizing best-ex pricing, refining hedge coverage, or preparing more comprehensive bid tapes for non-agency buyers, this update delivers the data leverage you need.

- Improved Pricing with Integration of Fannie Mae’s new Loan Pricing API – By combining various price factors and utilizing a broader set of data found in bid tapes, the new API provides greater price transparency on certain loans.

- Password Management Update – Updated functionality allowing users to reset their passwords if first attempt at entering password is incorrect.

- Quick Access to AOTs – A hyperlink has been created in the Master Trader tab to open up access to AOT’s done today. There is also the ability to view historical AOTs as well as the functionality to add the AOT’d position back to the hedge position.

- Training Center – Training Center access now available for all users. [View Video Recording]

- Hedge Advisor – A Data Updated time stamp has been added to the Hedge Adviser tab. [View Screenshot]

- Best Ex Raw Data Export – This functionality, which exists inside of the Bid Tape Review or Aggregate Tape Review popups, allows the user to pull the majority of their raw data from loans in the current loan sale to verify non normalized data points.

- Best Ex Analysis – The Compare Executions window now includes the non-spec price for Agency executions. [View Screenshot]

- Saved Best Ex – The user saving a best ex instance in the Commit Popup on the Best Ex Analysis tab will be cc’d on the email notification.

- Rapid Commit – When the Skip Price Confirmation option is selected in the Rapid Commit window, the commitment totals will update. [View Video Recording]

- Best Ex Analysis – On the Best Ex Analysis tab, a user can now run Agency Pricing across multiple delivery periods. MCTlive! will best ex across the user defined delivery periods. Up to 8 delivery periods can be defined per agency iteration. [View Video Recording]

- Mission Score added to Bid Tapes – Mission Score is now available to investors in the bid tape regardless of whether or not the loan is priced best under that program. This will allow investors to digest the score and provide any applicable payups.

- New Data Fields Now Available in MCTlive! – 28 new data fields are now available in our residential mortgage dataset. These additions are designed to give our clients even deeper insight and flexibility in hedge analysis and loan sale strategies. [View New Fields]

- Committed Held For Sale – Aged Loans Report – This new report will show any loans in committed held for sale greater than 30 days from the sold date.

- BE Held For Sale – Aged Loans Report – This new report will show any loans in BE held for sale greater than 30 days from the sold date.

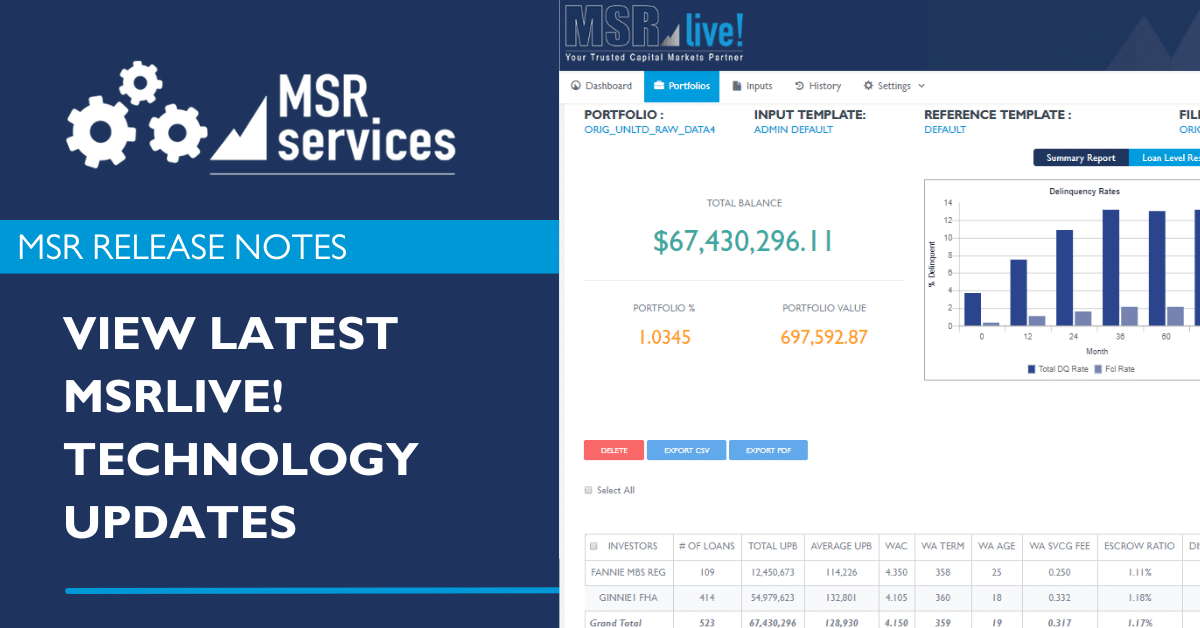

MSRlive! Release Notes

In addition to providing quarterly MCTlive! Release Notes, MCT’s MSR team also provides technology updates and release notes for users of the platforms. View the most recent MSRlive! releases below.

MCT’s MSR division will continue to produce monthly release notes specific to MSRlive!. MSRlive! is a robust mortgage servicing rights valuation tool used to manage servicing portfolios.

“From January through March 2025, fourteen enhancements to MCTlive! were released to improve execution, efficiency, and experience for clients.”

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

About the Author:

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

Steve Pawlowski contributes over three decades of expertise in mortgage and capital markets space to MCT. Steve is a strategic and highly accomplished Transformation Executive with a progressive record of success leveraging analytical capabilities, an entrepreneurial mindset, and innovative thinking to drive emerging technology advancements through process improvements and new business development.

Before joining MCT, Steve was the Senior Vice President and Head of Single-Family Products & Solutions, overseeing the design, development, and integration of Single-Family’s digital products and services across the residential mortgage loan life cycle. He was also responsible for fostering the integration of Fannie Mae’s technology and business infrastructure with its clients, facilitating their growth and value creation within the market landscape.

Prior to this, Steve served as the Senior Vice President and Head of the Capital Markets Journey in Single-Family, steering the development of products for the conduit and capital markets sector. He was responsible for the provision of execution tools, business solutions, and services, employing customer engagement, design thinking, innovation, and agile methodologies to deliver exceptional outcomes.