In this blog post and story, view recommendations from MCT’s MSR team on how to make speedy and informed retain-release decisions during periods of market volatility.

In this blog post and story, view recommendations from MCT’s MSR team on how to make speedy and informed retain-release decisions during periods of market volatility.

In these times of low but volatile interest rates, mortgage companies are thrilled with the greater volume of their origination pipeline, while left wondering about their servicing portfolio.

Yes, the portfolio has lost value but those new loans seem to have a lot of value…so maybe we should keep more of them? But if there are cash issues with retaining that might discourage me from keeping too many.

So, what’s a profit-maximizing mortgage company to do?

Enjoy our story of how you can get to that cash breakeven point even sooner!

The Cash Flow Problem: A Tale of MSRs in a Volatile Market

Sooo…let’s start at the beginning…

Your rates are falling through the floor and your lock desk is going crazy.

It’s getting crazy!!

Your underwriters and processors are all working overtime. You are increasing margins to slow down the flow and that barely puts a dent in it.

But what a great quarter you are having!

I’m getting rich! I think…

Except….

Your TBA hedges are having margin calls because of the rally. And you won’t get cash to pay them until your loans close in 30 to 60 days. Cash Squeeze! Ouch!

If only I could last 45 more days…

And…

Your MSR portfolio is taking a bath- runoff a near all-time highs, your mark to market is way down. And, if you are financing your MSRs, the lower mark means more margin calls, this time from your MSR finance provider. Double Ouch!!

If only I could last 45 more months…

And further…

Just when you are expecting nice and juicy prices from your aggregators, you find out they are in the same boat you are, overwhelmed with volume, worried about rates falling even more, trying to meet their cash needs of funding margin calls and owning servicing. And as a result, their bids are way back of where you anticipated.

No mas! No mas!

Truly the best of times and the worst of times…

What’s a Mortgage Banker to do in this Situation?

The short answer is to retain more servicing.

You are retaining relatively low rate new production. You are able to fund the loans by direct sales to the agencies much faster, clearing your pipeline and making it easier to meet those broker/dealer margin calls. And holding more servicing at a higher value will reduce the MSR financing margin calls as well.

But you still are not getting cash from the aggregators for the MSR value, so cash is still an issue!

Wouldn’t it be nice to have a tool which helped you select from all those loans, the loans which bring you back to cash breakeven as fast as possible?

Remember, the reason you hold MSR is because they do have positive cash flow, and eventually you will get the money you deferred by not selling to the aggregator.

But some loans, even though their MSR retain value is much higher than the implied release value of the correspondent, might still take a very long time to breakeven.

Waiting for breakeven…

And hey! Retained loans also have a tax advantage! You defer the taxes until you actually earn the servicing revenue.

And double hey! If you have MSR financing, you will be able to get to that cash breakeven point even sooner.

Paying taxes later is always better…

Wouldn’t it be nice if there was a tool that combined the best ex pricing with a cash flow servicing model incorporating tax effects and MSR financing effects to get a true picture of cash breakeven?

Suddenly, MCT’s Enhanced Best Execution (EBX) Technology to the Rescue!

In a flash, MCT’s Enhanced Best Ex (“EBX”) model takes the state of the art MCT Marketplace® auction process from MCTlive!® to get the best released prices, then creates loan level cash flows reflecting the true economics of the MSR.

That means incorporating individual subservicing cost and revenue sharing terms. Thus including actual banking relationships to get actual earning credit of escrows. In some cases, it means capturing recapture revenue based on the mortgage company’s actual retention division performance. It means loan level precise analysis. It means generating cash flows into the future based on these assumptions and current market prepayment and delinquency predictions.

All of this can be calculated by MCT’s state of the art MSRlive! model.

Now, if you can combine all that with the tax rate of the mortgage company, the MSR financing terms the mortgage company may have, you will get a true picture of how long it will take to get back the deferred cash that retention creates. And compute it on a loan level basis, you will have the perfect tool for making the proper retain/release decision for every loan.

That is what EBX does.

Example of How EBX Insights Empower Retain-Release Decisions

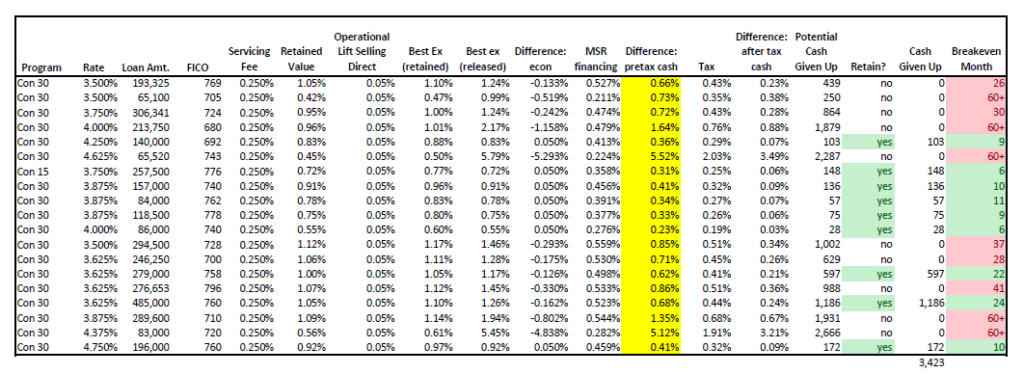

The above table shows the loan level result of the retain release decisions for a sample client’s recent auction of closed loans.

The econ value, while important, does not take into account the tax effect of selling released or the cash provided by financing. A client is able to set their breakeven cash flow (in this case, 24 months) and determine how many and exactly which loans to retain (9 in green out of 19 total) and how much cash it will set him back ($3,423).

Had the client kept all the loans, the cost in cash would have been $16,357 (not shown). Giving up that much cash every loan sale would quickly create a cash crisis at the mortgage company and some less than optimal decisions would have to be made.

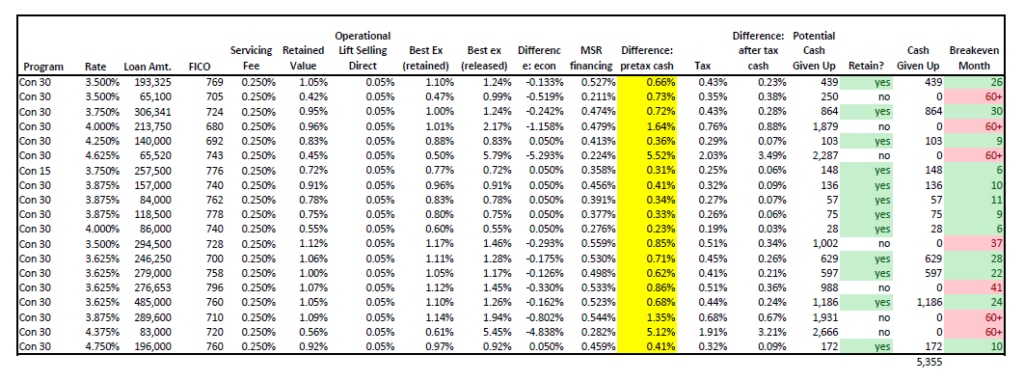

If the client felt better current balance sheet liquidity, they could decide to lengthen the number of months to breakeven and keep more loans. If the client decided, for example that they could afford to wait 30 months to breakeven, the table would look like this:

Now, 12 loans are retained instead of 9, and the cash delayed is $5,355.

As you can see, having a comprehensive tool to inform your retain-release decisions is essential to protect your profits during a period or volatility in the market. MCT’s EBX will give you that priceless peace of mind to know that the retain-release decisions you are making optimal given the circumstances.

Learn More About MCT’s EBX

Being able to make MSR retain-release decisions on the fly, and see what the results are in terms of retained portfolio, cash drain, and tax impacts are what make EBX so invaluable in times of crisis. This is just one of the many tools and advising support that MCT offers during times of market rate volatility.

For more information on EBX, and how it can help you create the optimal servicing portfolio, please contact your MCT sales representative for a demo. We are here to support!