After six consecutive rate increases of 50 BPS or more, as expected, the Fed raised rates by 25 BPS today (Wednesday), lifting fed funds to a new target range of 4.5-4.75%. More importantly, the committee continued to promise “ongoing increases” in overnight borrowing costs as part of its unresolved battle against inflation.

By keeping the promise of future rate hikes, the Fed pushed back against investor expectations that it was ready to signal the end of the current tightening cycle.

Parsing the Language of the Latest Fed Statement

It’s widely known that the Fed hopes it can continue dampening inflation toward its 2% target without triggering a deep recession or causing a substantial rise in the unemployment rate (currently around 3.5%). As the committee seeks to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time, the statement did indicate that any future rate increases would be in quarter-percentage-point increments, dropping a reference to the “pace” of future increases and instead referring to the “extent” of rate changes.

The statement marked an explicit acknowledgement of the progress made in lowering the pace of price increases from the highs of last year. Inflation, while having “eased somewhat,” still remains “elevated” based on the Fed’s preferred PCE measure. The most recent reading was a 5% annual rate in December, and inflation has been steadily declining for six months. The U.S. central bank did not issue new economic projections from its policymakers in the form of a “dot plot” and new projections won’t print until late-March. We will receive plenty of data between now and then.

Fed Chairman Jerome Powell and Wall Street have been facing-off against one another as of late with the central bank seeking to slow its inflation-fighting campaign without signaling a readiness to stop. Investors are hoping diminishing inflation will allow the Fed to imminently cease raising rates, and even cut them later this year. For now, let’s be happy that the U.S. economy is cooling just like the Fed wants, but growth hasn’t stalled, also as the Fed would hope.

The Fed’s Calculated Hand

So far, so good from the Fed, as further monetary policy tightening realigns the balance between supply and demand. The supply chain issues that drove up costs early in the pandemic have worked themselves out, and housing should disappear as a driver of inflation by the summer. The FOMC promised to take into account how the policy moves so far had impacted the economy, linking further rate increases to the evolution of upcoming economic data. The Fed admitted the U.S. economy was enjoying “modest growth” and “robust” job gains, with policymakers still “highly attentive to inflation risks.”

In a plan outlined at the Fed’s May meeting, policymakers began winding down its $9 trillion balance sheet on June 1 at an initial combined monthly pace of $47.5 billion of Treasuries and agency MBS. The runoff rate increased to $95 billion in September which puts the Fed on track to reduce its balance sheet by about $3 trillion over the next three years. The exit of the largest buyer in the MBS space caused a huge hole in demand and helped drive up interest rates.

Before we get ahead of ourselves, while prices for many goods are flat or declining, inflation for services remains high. If the Fed backs off monetary tightening too soon, inflation could again climb, this time on the back of a still-tight labor market. Fortunately, recent economic figures have added to mounting evidence that the worst bout of inflation in four decades has passed as the Fed’s aggressive tightening campaign filters its way through the economy. Incomes are the final piece of the inflation puzzle, and have been falling for three months. The Fed’s future moves will largely hinge on wage growth.

The Fed admitted the U.S. economy was enjoying “modest growth” and “robust” job gains, with policymakers still “highly attentive to inflation risks.”

The Case for Optimism. Or Not…

Does this mean prices will return to pre-pandemic levels? No. The inflation of the past 18 months means that prices have hit a new, higher plateau. Additionally, since monetary policy acts with a lag, by the time the data suggest that inflation is over, the Fed will be at risk of overshooting its mark, even with a robust labor market.

Not to whipsaw you back and forth, but let’s close by looking at the bright side. While the route ahead is still uncertain, there is a lot of confidence that we are returning to a sustained period of price stability. The Fed is now much closer to the end than the beginning of its tightening cycle, and mortgage rates have declined for four straight weeks. Mortgage rates have now fallen almost 40 BPS over the past month, and the 10-year U.S. Treasury yield fell 35 BPS in January. That narrowing spread between the two, having been abnormally wide since early 2022, is expected to put downward pressure on mortgage rates in the coming months.

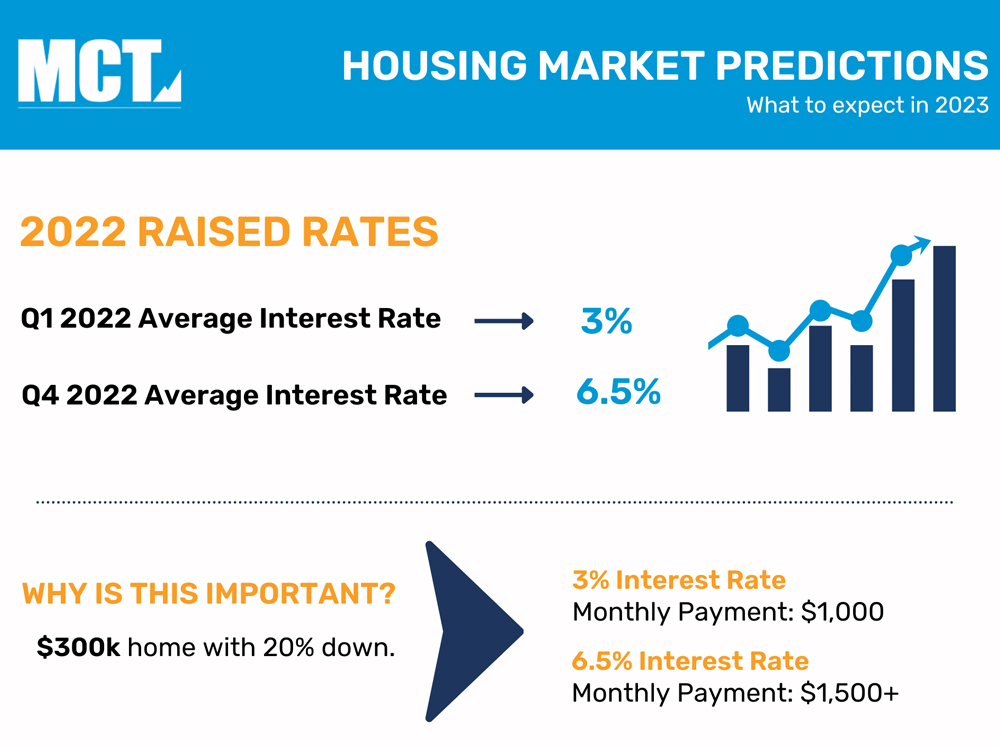

Remember to read housing market predictions for 2023 blog for an outlook on the future!

Time to Fully-leverage Secondary Mortgage Markets

In times of lean volume, lenders need to maximize their gain on sale, as such they must fully-leverage the secondary mortgage markets.

At MCT, we are always pushing the boundaries of digitization and automation in pursuit of efficiency, transparency, and profitability for our clients. At the same time, we pay cautious and necessary consideration to security and privacy of client data and information. We have a 20-year track record of doing what’s right for our clients.

We meet clients wherever they are in their growth cycle. And if they opt for autonomous use of our award-winning, all-inclusive capital markets platform, we’re ready to enable them. Near-term and long-term, it’s about helping our clients thrive.

Contact us today to learn more.

Subscribe for More Housing Market Updates

When you join our newsletter you get access to our daily and weekly housing industry commentary.