Even though the Federal Reserve cut interest rates by 25 basis points in December, the third time since September 2025, consumer confidence unfortunately dropped to recession levels in December. For the first time since the 1970’s, concerns about the labor market and inflation have risen in tandem. Inflation generally impacts the Low- and middle-income households more severely, which could curb their spending and/or increase the risk of default on their outstanding debts.

Credit card debt has risen to an all-time high of $1.21 trillion with a median interest rate of 25.3%, according to Academy Bank’s latest whitepaper. Currently a credit card user averages about $5,950 in credit card debt, which obviously adds to a borrower’s debt to income ratio. Prospective buyers continue to face an uphill battle qualifying for a mortgage; High property values, rising property insurance costs, and high debt to income ratios are the leading roadblocks to mortgage borrowing qualification.

Since the financial crisis of 2008, the average home buyers’ age has been rising steadily. More First-time and young home buyers are opting to wait and save more before attempting to purchase a home. This trend has led to the average age increasing from 29 years of age in the early 80’s to about 40 years of age in 2025. Current mortgage interest rates currently do not provide much relief. Mortgage interest rates are expected to trend between 5.50% and 6.00% during 2026, barring any unforeseen economic or political circumstances.

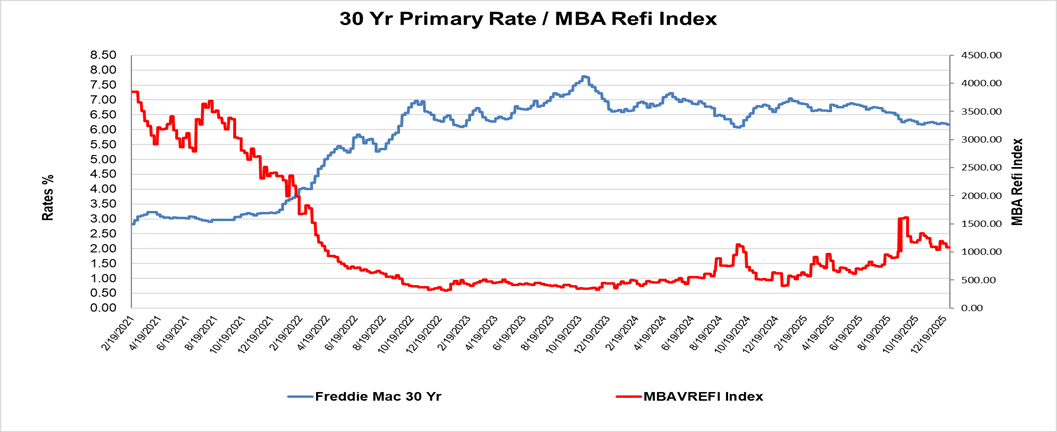

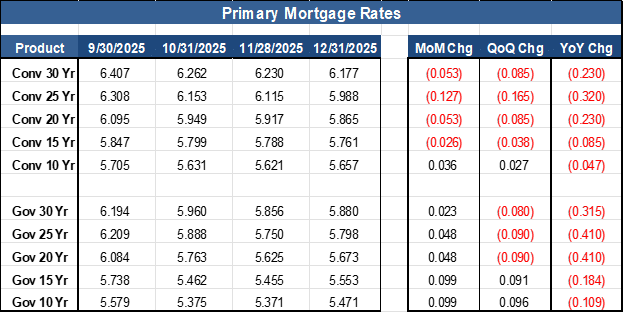

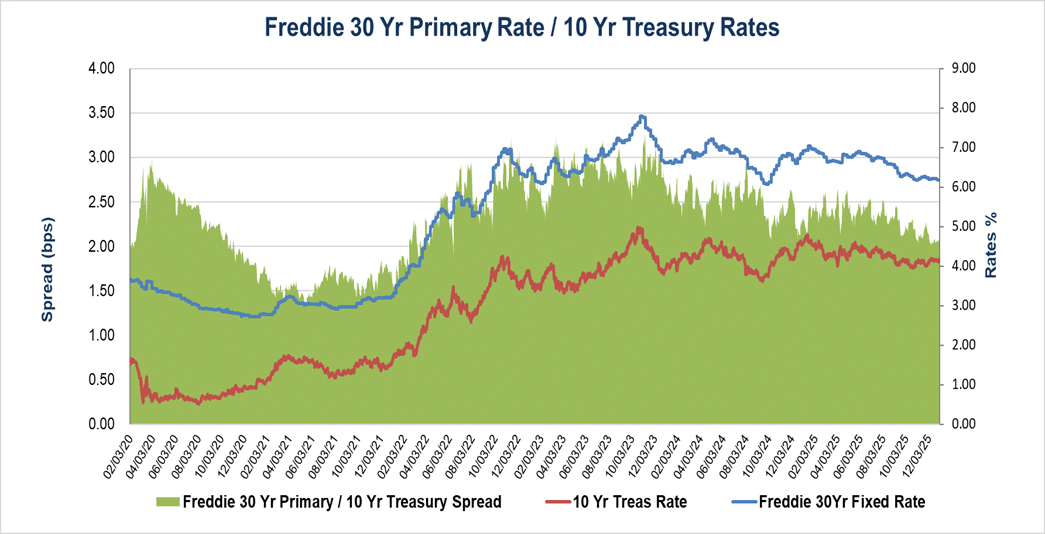

MCT’s Base Mortgage Rate declined from 6.23% to 6.18% at the end of December, representing a five (5) basis points decline since November 30, 2025, and 67 basis points since December 31, 2024. The Mortgage Bankers Association and Fannie Mae continue to project that rates will drop below 6.00% by the end of 2026.

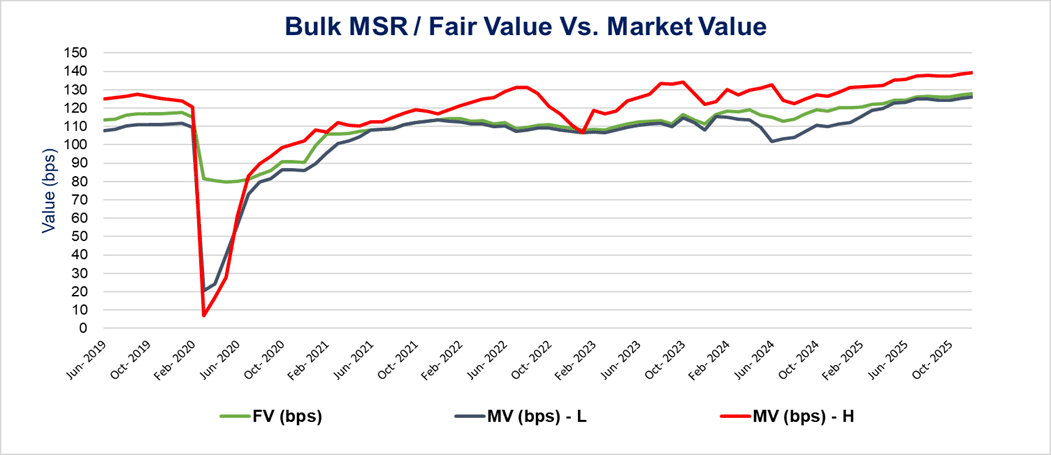

MSR fair values have remained robust and show little impact from current mortgage and float income rate volatility. We experienced continued strong demand for MSR during Q4, 2025, particularly by the aggregators, they kept MSR market values elevated as 2025 concluded. The mortgage industry has also experienced some consolidation during the second half of 2025 and we should anticipate that trend to continue throughout 2026.

New Production and Value Trends:

Refinancing activity has continued its downward trend during the month of December with lock rates dropping by 19% according to MCT’s Sr. Director Andrew Rhodes.

MCT’s data shows a continuous slowdown in prepayment speeds during December due to mortgage rates leveling off and borrowers’ caution from general economic uncertainties and job market direction.

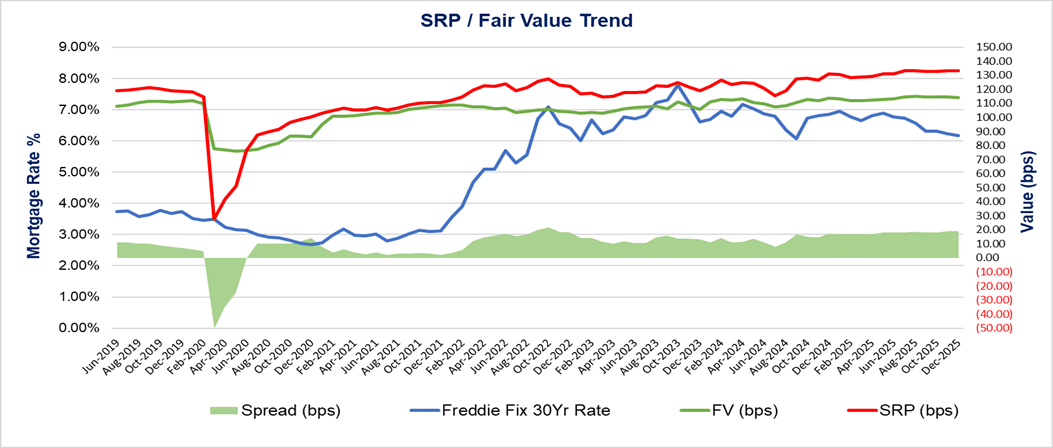

Current servicing released premiums (SRP) remain relatively strong as the large aggregators continue to offer record SRP prices, including FHA production. We anticipate those levels to remain elevated during Q1, 2026.

The current average SRP levels remain at about 12-20 basis points higher than the average fair value. We continue to advocate for caution when capitalizing new MSR production at moderate price levels as current SRP levels reflect the aggregator’s economies of scale rather than actual fair value.

Bulk MSR Market

The MSR market ended the year with a slew of bulk trades as MSR sellers took advantage of MSR buyers demand and take some risk off the balance sheet prior to any potential mortgage rate decline.

MSR buyers have remained bullish about the strength of the MSR markets and their appetite to purchase more MSRs in the near future continues. The MSR market could experience additional transactions and/ or mergers during Q1, 2026 to cash in on some of the strong MSR values and mitigate against possible economic uncertainties. MSRs continue to offer attractive yields and income for servicers, especially when loan originations volume remains low.

Bulk MSR portfolios continue to trade at servicing fees multiples between 5.00X and 5.50X. Government MSRs with no delinquencies and with interest rates below 5.00% continue to trade at 4.00X or higher. Newer conventional loan vintages from 2024 and 2025 are trading at between 4.00X and 4.50X multiples of servicing fee.

Non-QM and Second Mortgages Trends

Though non-QM production remained strong by the close of 2025, a closer look into servicing performance is warranted as delinquencies and prepayments continue to rise. MCT’s data reveals that recent prepayment levels crossed into the double-digit zone during Q3, 2025 and remained elevated during Q4, 2025.

Non-QM loan production has averaged about $50 billion per quarter and is expected to remain robust throughout 2026. With rising borrowers’ debt to income ratios, non-QM is probably the only available option for many borrowers.

The non-QM production levels could experience some elevated levels as more lenders enter this space and investors demand non-QM loans increase, thus pushing non-QM mortgage rates even lower and potentially in line with Agency loan’s rates.

HELOC and Home equity loan rates jumped sharply by the end of 2025. Current HELOC rates have reached above 8% while the average Home Equity loan rate sits right at 8%. Inflation expectations led to the rise in HELOC and Home equity loans rates. This segment of the market would experience lower rates if the Fed cut the overnight rate by 75 basis points as their forecast indicates.

HELOCs and closed end second mortgage production leveled off by the close of 2025. HELOC and Home Equity loans remain a viable option for many potential borrowers that have high home equity levels in their possession.

The bulk MSR market for these two segments remains virtually nonexistent. Underlying fair values for non-QM MSR products remain between 3.65 – 4.25 multiple of servicing fee while Second Mortgages and HELOC MSR products fair values are between 2.30x and 3.25x multiples of servicing fee.

Mortgage Rates

As of December 31, 2025, the current fixed 30 Year mortgage rate is 6.177%, which represents about five (5) basis points decline from their November 30, 2025, mark.

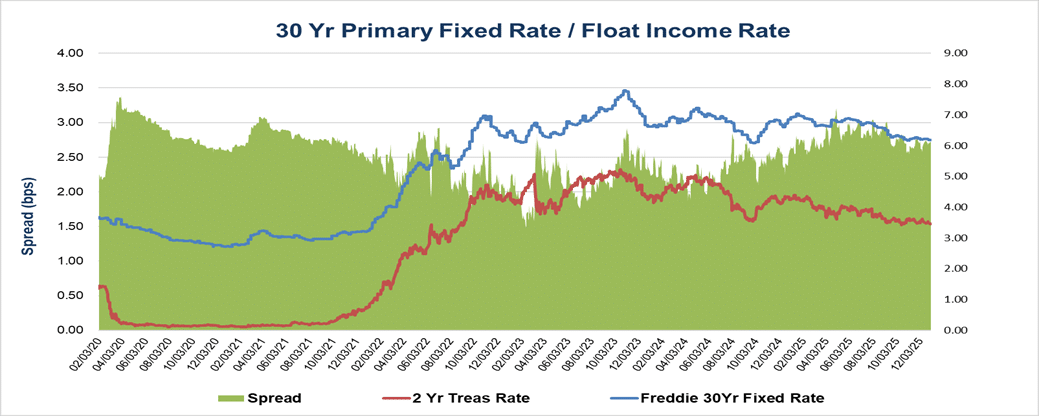

Escrows and Float Income

Mortgage escrow values dropped slightly from their November 30, 2025 marks due to the two (2) basis point decline in float income rates. It’s important to note that the Escrow float income value is the second largest contributor to the overall MSR value.

Rates Indices

Mortgage rates have edged slightly lower from their November 30, 2025 marks. MCT’s Primary 30 Year mortgage rate declined by five (5) basis points to 6.177%.

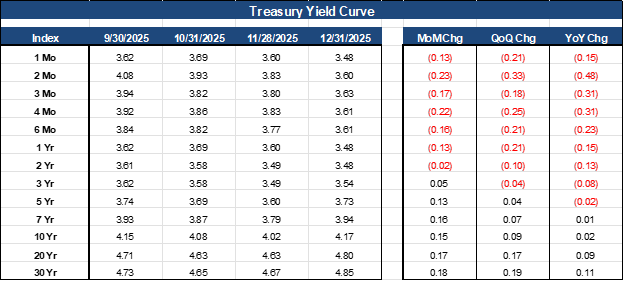

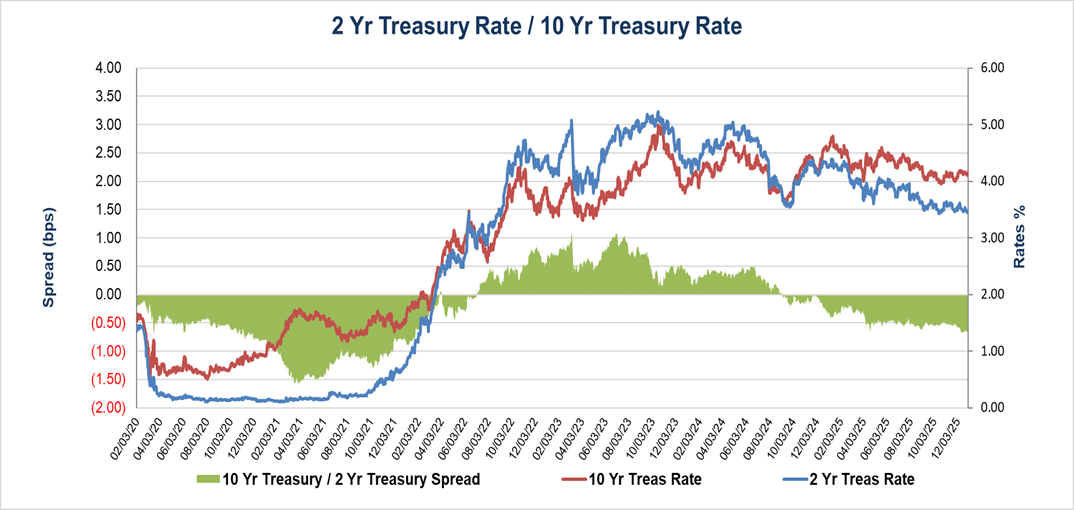

The current Treasury Yield Curve continues to reflect some economic distress and future economic uncertainties.

The yield on the benchmark 10-year Treasury is currently at 4.17%, sixteen basis points higher than the prior month. The current yield curve is slightly flatter than the prior month, however, the Treasury curve remains steeper as the lower end of the curve dropped while the long end of the curve remained high, reflecting investor’s continued demand for higher yields due to the current economic uncertainty.

The current spread between the 2 Yr Treasury rate and the 10 Yr Treasury rate is on a trajectory that signals the potential for more economic challenges ahead. The current spread has widened by 17 basis points since November 30,2025.

Fair Value Guidance

Our December 31, 2025, fair values’ guidance for existing portfolios should remain relatively unchanged or result in a slight decrease from their November 30, 2025, marks. Mortgage rates have retreated by an average of about five (5) basis points, and the float income rate has declined by two (2) basis points since November 30, 2025; Therefore, we anticipate that most of the decline in the value, if any, should stem from the mortgage rates decline.

MSR holders should expect a maximum decrease in fair values by less than one (1) basis point, primarily due to the decrease in mortgage rates.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between 0 to 1 bps change from November 30, 2025, marks.

- Government loans between 0 to 1 bps change from November 30, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net