The Federal Reserve lowered its benchmark interest rate by 0.25 percentage points in September. This was the first rate cut since December 2024. This rate cut came on the heels of a stalling labor market and slower economic growth, and right before the government shutdown. The Federal Reserve is now eyeing two more rate cuts before the end of 2025, and potentially only one in 2026, according to the central bank’s summary of economic projections. The current benchmark interest rate is 4.00%-4.25%.

Consumers and businesses alike are concerned about the general health and direction of the economy. Hiring rates and layoff rates are currently relatively low as employed people are reluctant to switch jobs as they monitor the economy’s health and rising living expenses.

Despite mortgage interest rates at their lowest in a year, the housing market’s turnover pace continues to slow in most parts of the country as homes are taking longer to sell. Home price appreciation has continued its slowing trend nationally, even declining in several states. Current mortgage rates are hovering around 6.25% providing the opportunity for buyers. However, according to realtor research data, housing supply growth is slowing. Nearly 20% of listings experienced price reductions in September 2025.

New Production Value Trends:

According to MCT’s data, September demonstrated strong momentum with total lock volume up 14.03% month over month and 13.42 year over year. The surge was driven primarily by rate/term refinances which skyrocketed by 183.54% from the previous month. Borrowers took advantage of declining rates prior to the Fed’s September meeting and rate cut announcement.

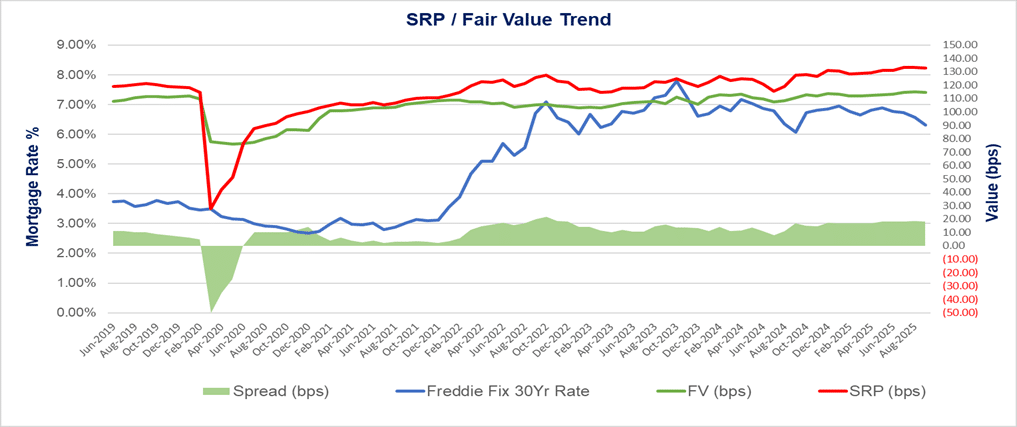

Current servicing released premiums (SRP) remain relatively strong as major aggregators continue to offer record SRP prices, including FHA production. This is purely driven by supply and demand dynamics as low production volume persists. We anticipate those levels to remain elevated through the end of 2025.

The current average SRP levels remain at about 15-25 basis points higher than the average fair value. Many lenders with servicing portfolios are faced with tough choices related to retaining some of their loan production or selling on a servicing release basis. We also continue to advocate for caution when capitalizing new MSR production at moderate price levels as current SRP levels reflect the aggregator’s economies of scale rather than actual fair value.

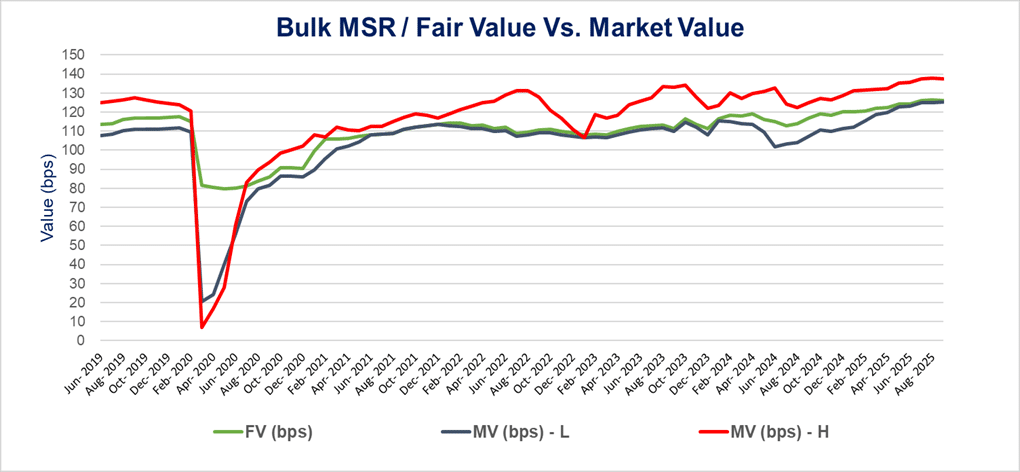

Bulk MSR Market

Since mortgage interest rates started declining by early September, the Bulk MSR market experienced an influx of offerings of more than $50 Bn during September, which is likely to grow to over $100 Bn during October. The majority of the bulk MSR deals are currently direct trades between the seller and buyer. MSR owners are trying to capitalize on their holdings and while market values remain near record levels and before further declines in mortgage interest rates.

Bulk MSR trades for moderately seasoned portfolios with interest rates below 5.00% continue to trade at servicing fees multiples between 5.00X and 5.50x.

Demand for bulk MSR portfolios and elevated market prices should remain relatively robust as 2025 comes to a close.

Non-QM and Second Mortgages Trends

Non-QM production growth continues to outpace agency loans production as more borrowers and investors are opting alternatives to agency loans financing. The tightening of the spread in interest rates between Non-QM and Agency products is further fueling demand for such mortgage products. Current interest rate spread between agency mortgage loan and Non-QM mortgage loans is ranging between 40 and 70 basis points.

Non-QM delinquencies and payoffs are on the rise and have started to outpace agency conforming levels, particularly within higher interest rate ranges as borrowers take advantage of the falling mortgage interest rates.

HELOCs and closed end second mortgage lenders continue to experience robust production during the month of September. Market participants should expect continuous growth within this segment throughout the remainder of 2025.

The bulk MSR market for these two segments remains virtually nonexistent. Underlying fair values for Non-QM MSR products remain between 3.65 – 4.40 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30x and 3.25x multiples of servicing fees.

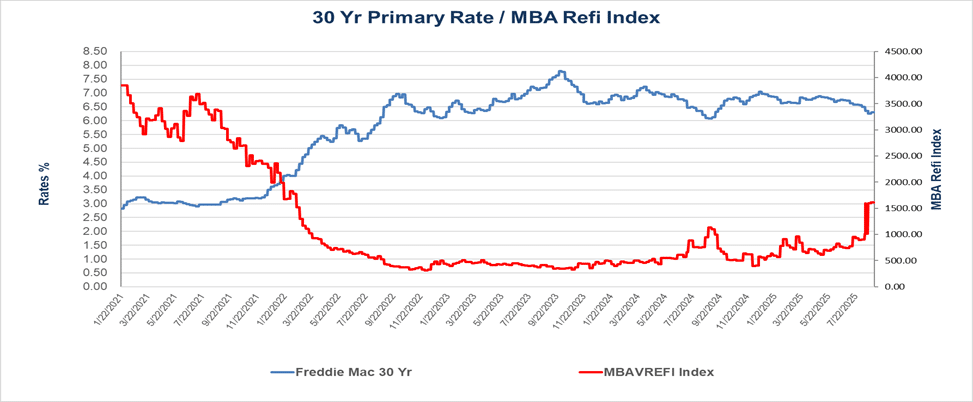

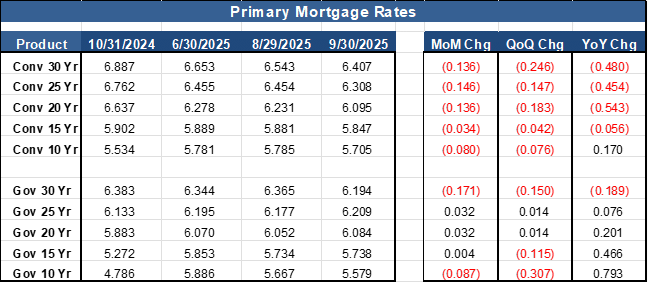

Mortgage Rates

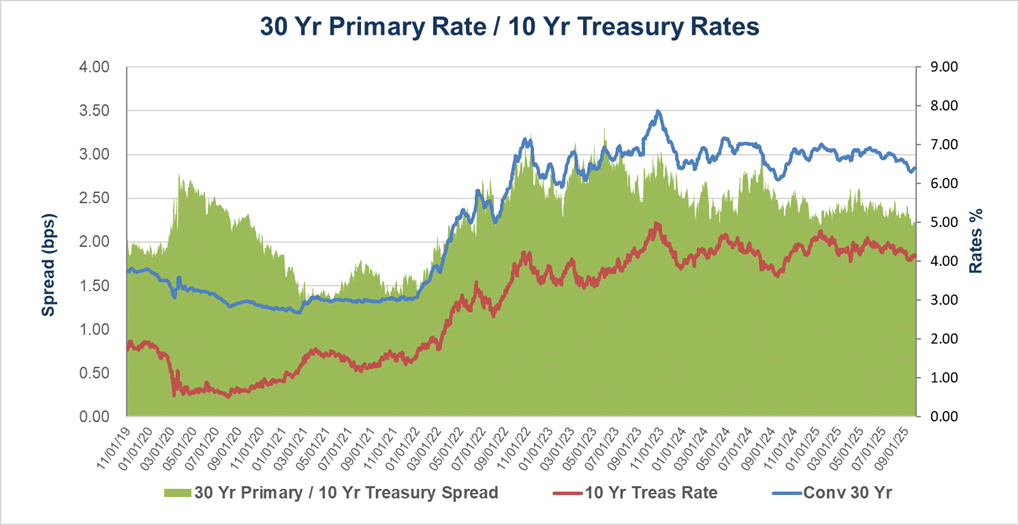

As of September 30, 2025, the current fixed 30 Year mortgage rate is 6.407%, which represents about 14 basis points decline from August 31, 2025, mark.

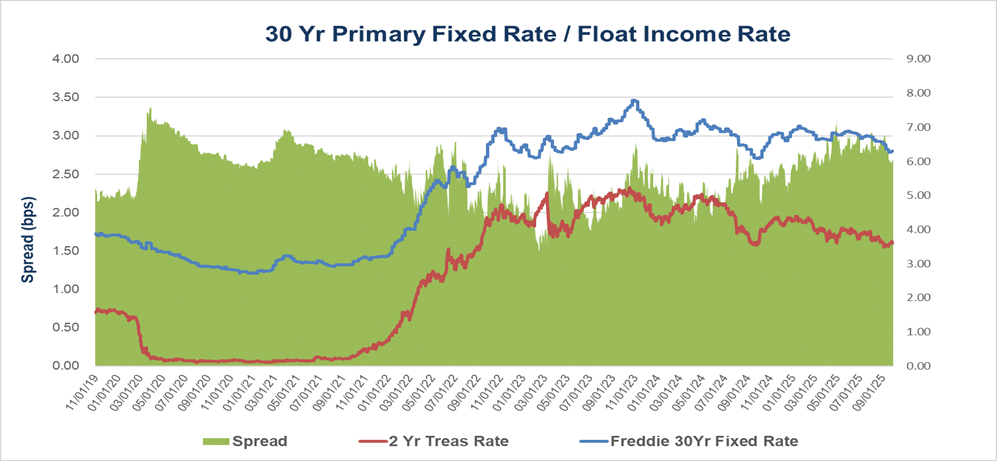

Escrows and Float Income

Mortgage escrow values have remained relatively unchanged since their August 31, 2025 marks due to float income rates have remained relatively unchanged during the same period. The escrow float income value is the second largest contributor to the overall MSR value.

Rates Indices

Current mortgage rates reflected economic news and uncertainty and the Fed’s 25 basis points benchmark interest rate cut during the month of September 2025. The primary 30 year fixed rate declined by about 14 basis points since August 31, 2025.

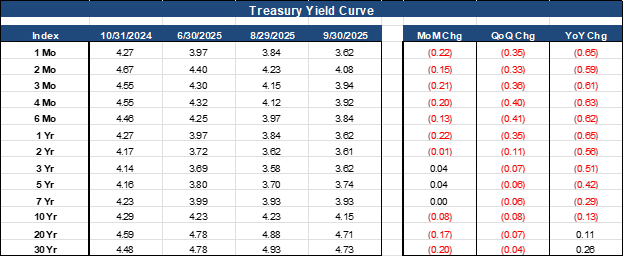

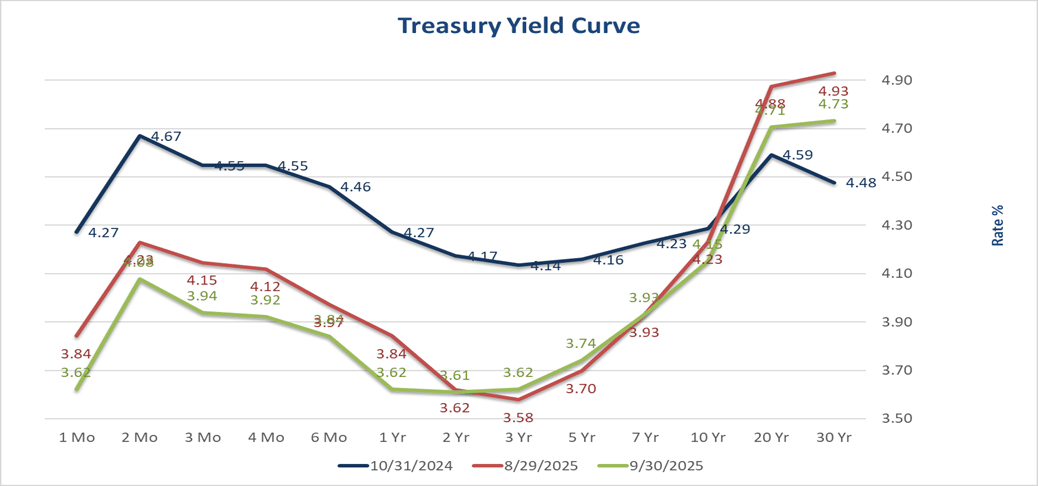

The current Treasury yield Curve continues to reflect some economic distress and future economic uncertainties.

The yield on the benchmark 10-year Treasury is at 4.15%, eight (8) basis points lower than prior month. The current yield curve is steeper as the lower end of the curve declined while the long end of the curve remained high, reflecting investor’s continued demand for higher yields due to the current economic uncertainty.

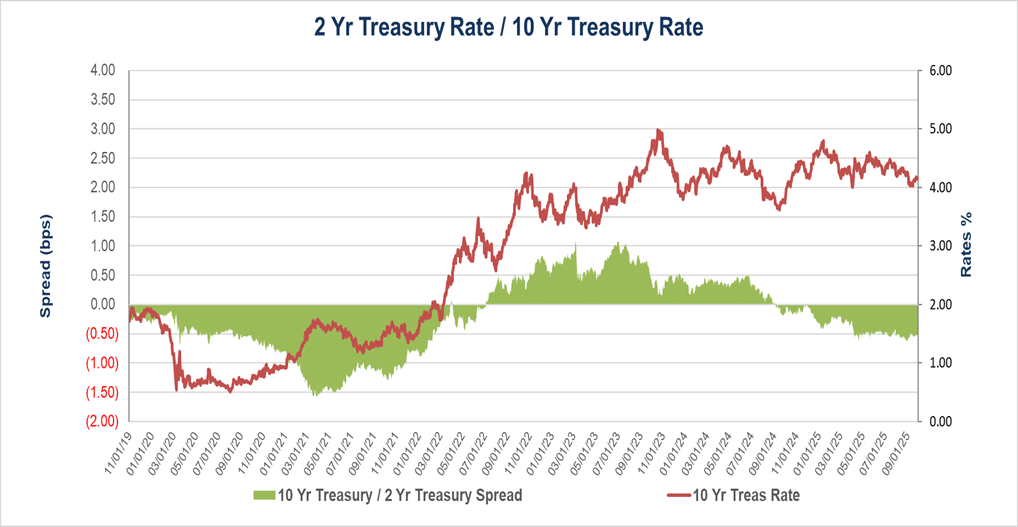

The current spread between the 2 Yr Treasury rate and the 10 Yr Treasury rate is on a trajectory that is similar to the period immediately after the pandemic, which could mean more economic challenges lie ahead.

Fair Value Guidance

Our September 30, 2025, fair values guidance for existing portfolios should slightly decrease from their August 31, 2025, marks. The float income rate has remained relatively unchanged since August 31, 2025; Therefore, it has little impact on the escrow component of the value. The decrease in mortgage rates from August 31, 2025 marks will lead to most of the decline in fair values.

MSR holders should expect a decrease in fair values ranging from less than one basis point to two (2) points, primarily due to the decrease in mortgage rates.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between -1 to -2 bps change from August 31, 2025, marks.

- Government loans between -1 to -3 bps change from August 31, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net