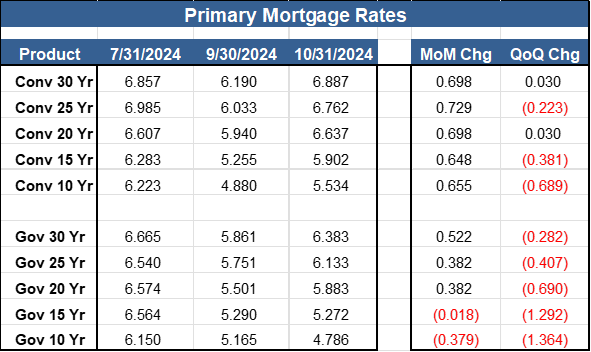

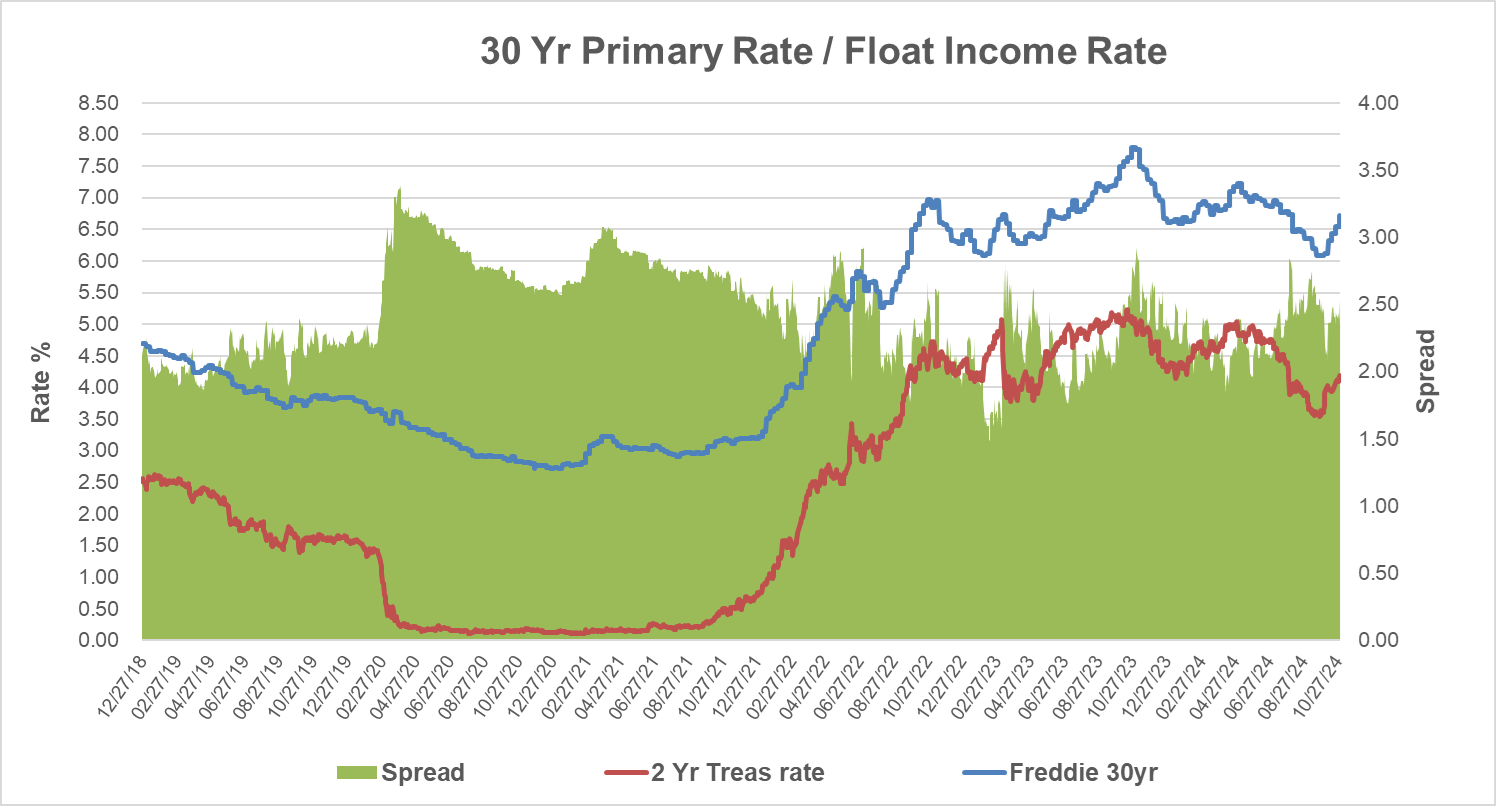

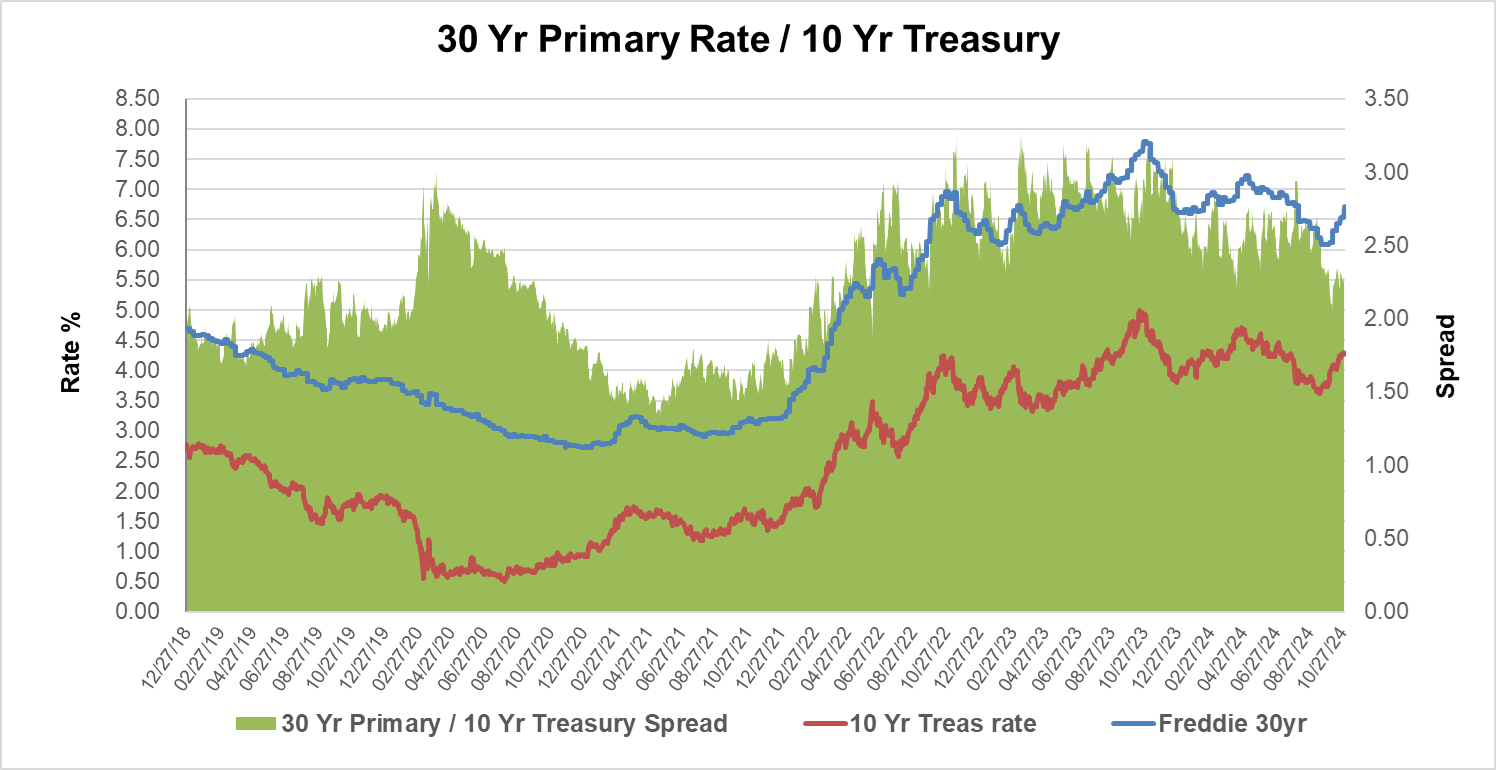

Here we go again! Mortgage rates and all other rate indices continue their roller-coaster ride quarter after quarter. After so much anticipation of lower mortgage rates to remain throughout the rest of 2024, rates took a sharp U-turn and are back up about 68 basis points from their lows on September 30, 2024. The current rates reversal is significant since it took such a short time to get to back up to the same point where market rates were just three months ago. Current mortgage rates are about the same level as they were around July 31, 2024. The financial market is expecting the Fed to lower the overnight rate by 25 basis points during their November meeting as the economy and the job market remain robust. We estimate that mortgage rate will remain elevated through the remainder of 2024, barring any political or economic surprises.

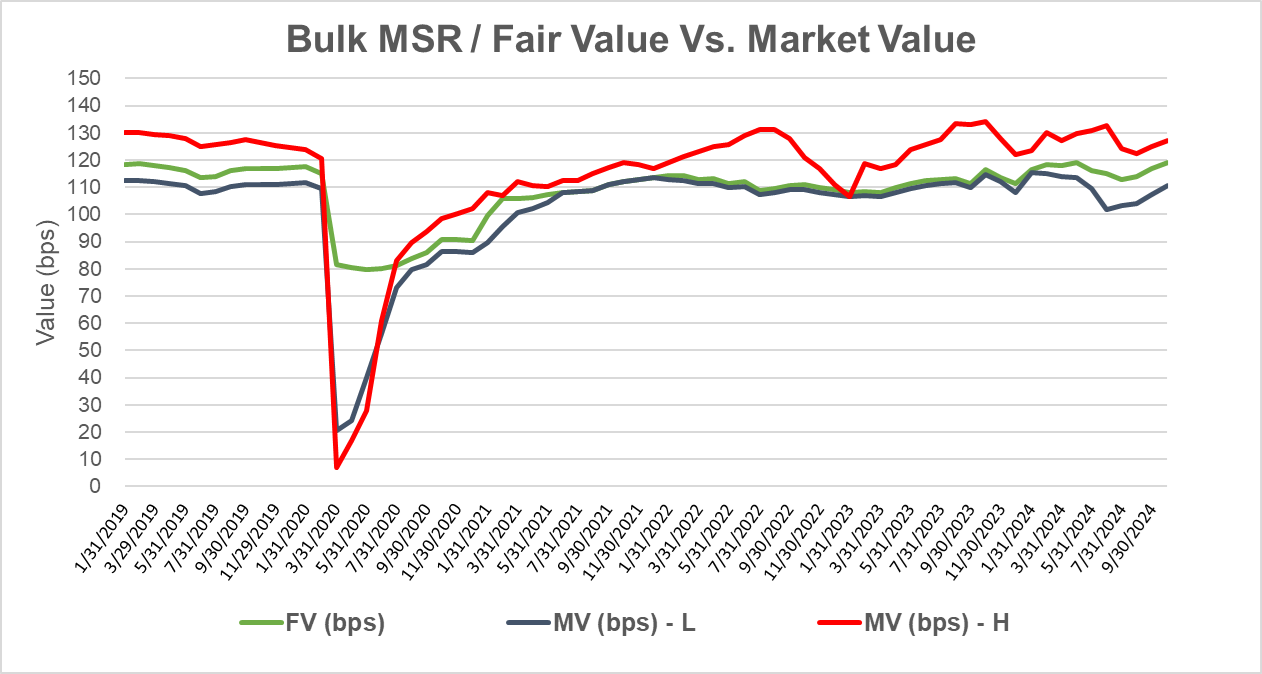

MSR values during Q3 declined by about 4-10 basis points, depending on portfolio characteristics. This decline was driven by the 80 plus basis points decline in mortgage rates and about 120 basis points decline in float income rates. This sharp decline in MSR values has led to mortgage servicing losses across the industry during Q3. On a positive note, mortgage rates and float income rates have recovered about 85% of the total mortgage rate drop since the end Q3. We estimate that MSR values should recover at least 50% of the value losses experienced at the end of Q3.

Demand for MSR remains robust and MSR prices are competitive across all products and vintages. Low MSR supply and persistent low production volume have kept MSR values at very competitive levels and should remain so in the near future.

Mortgage prepayments, though historically very low, continue to reflect steady and persistent upticks across all vintages. Most of the prepayments resulted from the short-lived mortgage rate drop during Q3 and were concentrated within 2022-2023 vintages.

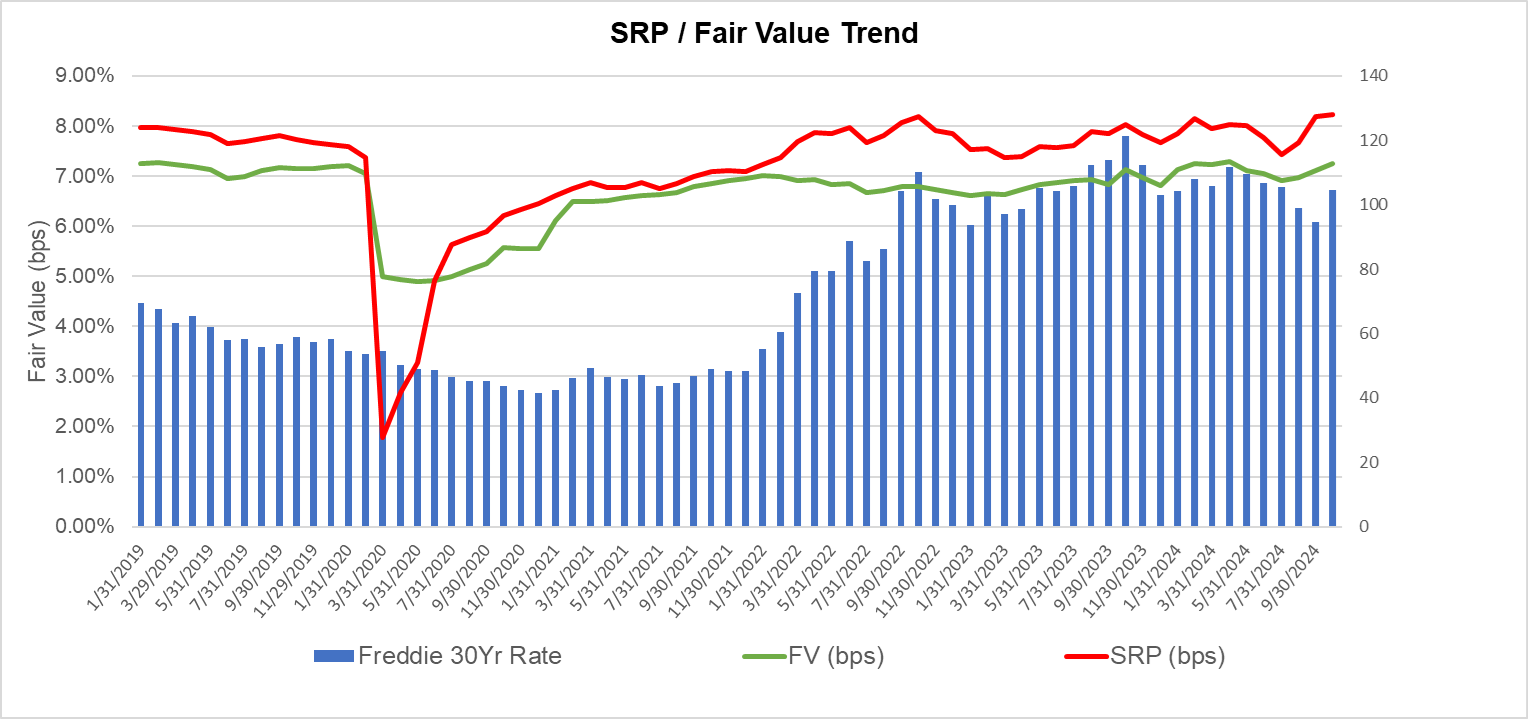

After a robust increase in mortgage refinancing activity during Q3 due to lower mortgage rates, it dramatically slowed down during the month of October. Many aggregators, after a short-lived reduction in their SRP pricing in September, have increased their prices for new originations which have been ranging 125 -130 bps for a 30 Yr par rate Loan. Demand for new production is as high as ever as the market enters the final stretch of 2024.

All of the mortgage market euphoria about lower rates and higher anticipated increase in production has since evaporated. Lenders have tamed their expectations of lower rates as we come to the close of 2024. All eyes and hopes for lower rates have now shifted to 2025. The MBA is forecasting a 28% increase in mortgage production to $2.3 trillion in 2025 and its baseline 30-year mortgage rate at 5.90% by the end 2025. The MBA also anticipates that 63.5% of mortgage production will come from purchase volume.

MSR Bulk Market:

The number of bulk MSR trades has declined during Q3 compared to the first two quarters of 2024. However, market values have remained strong despite the slight weakness in bulk MSR pricing during Q3, 2024. As new loan production remains weak, demand for bulk MSR will remain strong during the remainder of 2024.

Recent bulk MSR trading values reflect levels of 4.95x – 5.20x multiples of servicing fees for agency loans. Many potential MSR sellers remain hesitant to sell their MSRs due to loan production uncertainty driven by higher than anticipated mortgage rates. Many MSR holders depend on their MSR holdings fee income to maintain their business operations. Until mortgage lending activity shows a more steady and robust increase in production levels, many MSR holders prefer to wait a little bit more before selling some of their MSR holdings.

Second mortgages and HELOC loan originations continue their growth at a rapid growth rate that exceeds 20% QoQ. Similarly, Non-QM originations continue to increase as more institutional investors pursue such products. As rates declined during Q3, 2024, Non-QM prepayments within 2023 vintage increased sharply to lower double digits, however, other vintages experienced more moderate increases, but mostly remained in the high single digits.

We anticipate this growth in these product segments to continue for the rest of 2024 and throughout 2025. Many insurance companies are actively adding Non-QM whole loans to their portfolios. DSCR (Debt Service Coverage Ratio) loans have become one of the most sought after Non-QM products by institutional investors due to its potentially higher yields and better performance.

The underlying fair values and demand for such products are very competitive; Non-QM MSR products’ fair values are generally between 3.65 - 4.125 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30 – 2.85 multiple of servicing fees.

As of October 31, 2024, the current 30 Year base mortgage rate is 6.8872%, which represents about 70 basis points increase from September 30, 2024, mark, and three (3) basis points increase QoQ. We anticipate existing portfolio fair values to increase by 3-6 basis points from their 9/30/2024 marks, depending on the underlying portfolio characteristics and vintage. While overall values should remain strong, most of value volatility will be concentrated within the 2023 and 2024 vintages as they are more sensitive to rate changes compared to 2020 – 2022 vintages. Almost all of 2020-2022 vintages should reflect slight increases in value as well.

Mortgage escrow values remain robust and should continue to buoy overall MSR values. It is the second largest contributor to the overall MSR value as float income rates remain high. Property values are expected to rise during 2025 by about 4%-5% which could lead to higher borrowers’ monthly tax and insurance payments. Though that would be beneficial for MSR values, it increases borrowers’ default risk.

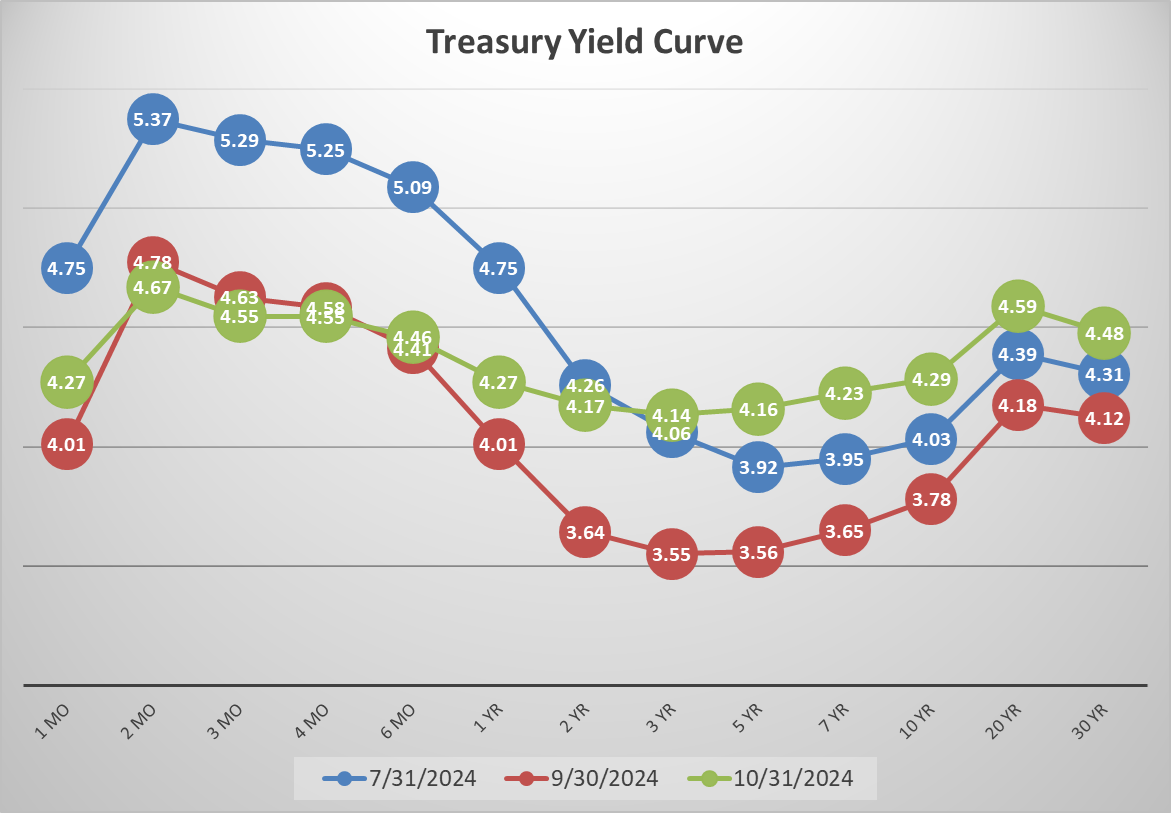

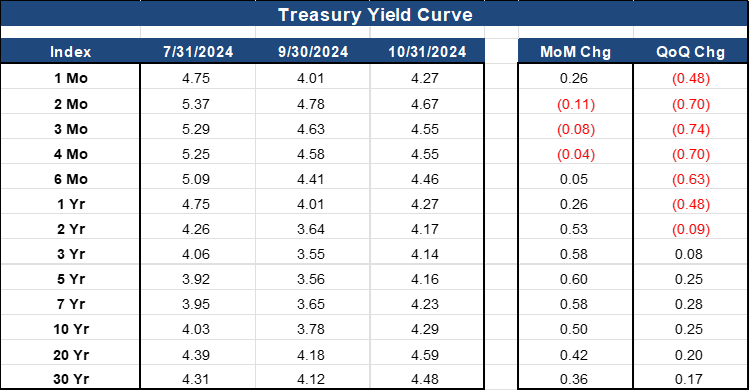

The treasury yield curve is becoming less inverted and continues to improve over time. It is slowly trending back to its normal trajectory prior to the Fed’s rate hikes that started in late 2022. The yield curve continues to reflect market and Fed’s optimism about controlling inflation.

Our estimate of the fair values for existing portfolios should improve by 3-6 basis points from September 30, 2024, marks, depending on portfolio characteristics.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between +1 to +5 bps change from September 30, 2024, marks.

- Government loans between +2 to +6 bps change from September 30, 2024, marks.

- Delinquencies continue to rise across all mortgage products, particularly within FHA backed mortgage portfolios. Current FHA delinquency reached 10.33% at the end of Q3, 2024, while VA delinquencies reached 4.52%. The concern lies within the 30-day delinquency category, FHA loans reached 5.33% while VA loans were at 1.88%. Those levels are the highest since Q3, 2021.

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net