About MCT

MCT is a leading source of innovation for the mortgage secondary market, revolutionizing how mortgage assets are priced, locked, hedged, traded, and valued. From architecting modern best execution loan sales to launching the most successful marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship.

Core Values

Our core values are the foundation for how we collaborate with clients, team members, and industry partners.

Drive to Transform

Harnessing market knowledge and innovative technologies to challenge the status quo and deliver superior results.

Community

Supporting and elevating our clients, partners, MCT team members, and the borrowers whom we all serve.

Trust

Building lasting relationships with knowledge, strong character, and appreciation.

Humility

Achieving mutual success through listening, thoughtfulness, and hard work.

The MCT Mission

Fueling the mortgage industry with transformational capital markets technology and personalized client experience.

Our History – A Timeline of Client-Focused Innovation & Support

MCT was founded in 2001 as a service-first mortgage pipeline hedging boutique.

MCT built trusted relationships with clients and partners, like the GSEs and large investors, and established itself as the dominant hedge provider in the U.S.

Coupling emerging technologies with a drive for client success, MCT became the choice for lenders large and small.

MCT is the de facto leader in mortgage capital markets technology. Clients now enjoy access to a deep bench of prominent experts and technology innovations that push the industry forward.

Meet the Team

MCT team members have first-hand experience at a wide range of mortgage industry institutions. They help clients build valuable connections, increase operational efficiency, and optimize profitability.

Executives

Management

Sales

Curtis Richins

President & CEO

Chris Anderson

Chief Administrative Officer

Steve Pawlowski

Managing Director, Head of Technology Solutions

Phil Rasori

Chief Operating Officer

Ian Miller

Chief Marketing Officer

Thomas P. Farmer

Chief Investment & Corporate Development Officer

Leslie Winick

Chief Strategy Officer

Ben Itkin

Managing Director, Head of Sales

David Bricker

Chief Financial Officer

Andrew Rhodes

Sr. Director, Head of Trading

Paul Yarbrough

Sr. Director, Head of CSG & Analytics

Sarah Hellman

Director, Lender Business Intelligence

Justin Grant

Sr. Director, Head of Investor Services

Bill Shirreffs

Sr. Director, Head of MSR Services and Sales Operations

Luke Chang

Director, Product & Pricing Division

Chad Campora

Sr. Director, Head of Human Resources

Jennifer Kennelly, CMB, AMP

Sr. Director of Investor Services

Lorene Good

Director, Finance & Controller

Natalie Arshakian

Sr. Director, Head of Lock Desk Operations

Azad Rafat

Sr. Director, MSR Services

Jessica Visniskie

Director, Client Success Group

Danyel Shipley

VP, West Regional Sales

Chad Stone

Director, Northwest Regional Sales

Cara Krause

VP, Northeast Regional Sales

David Burruss

Director, MSR Sales

Page Woodall

VP, Southeast Regional Sales

Scott Holtz

VP, South Regional Sales

Executives

Management

Sales

Curtis Richins

President & CEO

Phil Rasori

Chief Operating Officer

Thomas P. Farmer

Chief Investment & Corporate Development Officer

Ben Itkin

Managing Director, Head of Sales

Chris Anderson

Chief Administrative Officer

Ian Miller

Chief Marketing Officer

Leslie Winick

Chief Strategy Officer

David Bricker

Chief Financial Officer

Steve Pawlowski

Managing Director, Head of Technology Solutions

Andrew Rhodes

Sr. Director, Head of Trading

Justin Grant

Sr. Director, Head of Investor Services

Chad Campora

Sr. Director, Head of Human Resources

Natalie Arshakian

Sr. Director, Head of Lock Desk Operations

Paul Yarbrough

Sr. Director, Head of CSG & Analytics

Bill Shirreffs

Sr. Director, Head of MSR Services and Sales Operations

Jennifer Kennelly, CMB, AMP

Sr. Director of Investor Services

Azad Rafat

Sr. Director, MSR Services

Sarah Hellman

Director, Lender Business Intelligence

Luke Chang

Director, Product & Pricing Division

Lorene Good

Director, Finance & Controller

Jessica Visniskie

Director, Client Success Group

Danyel Shipley

VP, West Regional Sales

Cara Krause

VP, Northeast Regional Sales

Page Woodall

VP, Southeast Regional Sales

Justin Putz

Director, Midwest and Mountain Regional Sales

Scott Holtz

VP, South Regional Sales

David Burruss

Director, MSR Sales

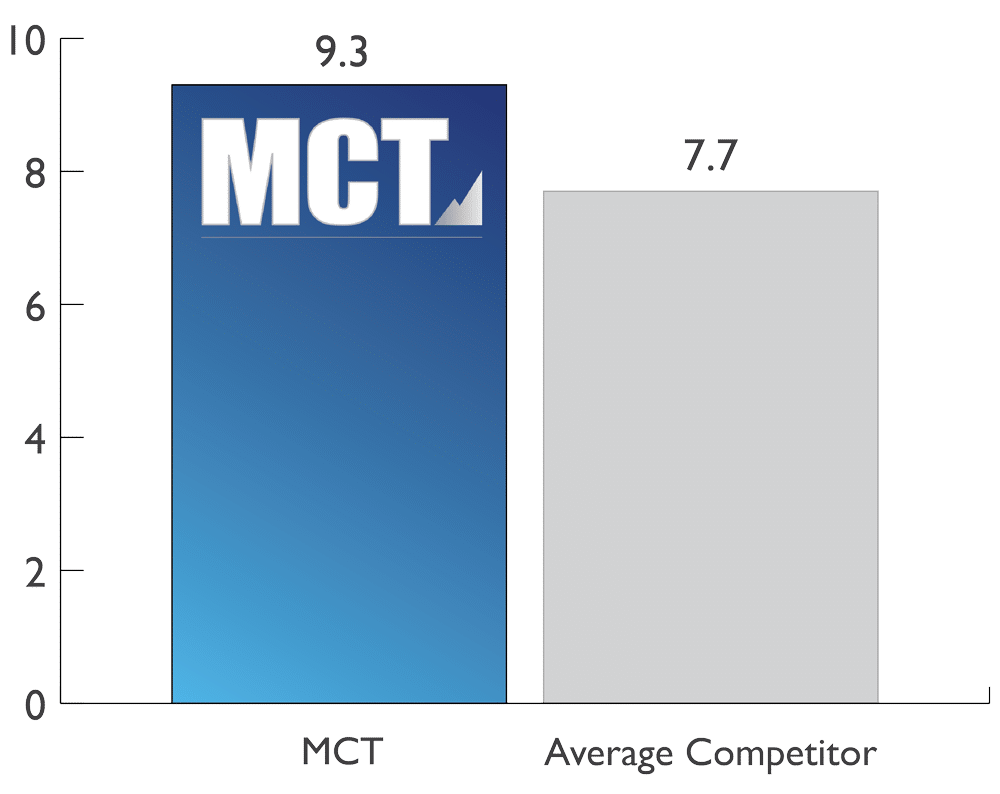

Proven Track Record of Client Satisfaction & Loyalty

When you need them, MCT experts are a click or call away — every time. And when not connecting directly, the MCT team is proactively monitoring your performance. That’s why our clients have consistently rated us as their top provider for satisfaction and loyalty.

I feel like MCT rolled out the red carpet for Virginia Credit Union. I can’t say enough good things. MCT has come through with every single thing I’ve asked for. – Caleb Jeppsen, VP of Secondary Marketing, Virginia Credit Union

I feel like MCT rolled out the red carpet for Virginia Credit Union. I can’t say enough good things. MCT has come through with every single thing I’ve asked for. – Caleb Jeppsen, VP of Secondary Marketing, Virginia Credit Union

Overall Satisfaction

Net Promoter Score

Hear What Clients Say About MCT

Careers

MCT’s greatest hallmark is its people. We are barrier-breaking, “get ‘er done” folks with a sense of purpose (and humor), who share a deep desire to improve the mortgage capital markets. We are driven by a common goal to help our clients succeed and enjoy the ride with them.

If you’re interested in becoming a team member, review openings below and use the form to get in touch with us.

Senior CMTA - Client Success Group ($100-150K per year)

JOB DESCRIPTION

The Senior Capital Markets Technology Advisor is a high impact role within MCT’s Client Success Group (CSG). Reporting to the Director of CSG, the Senior Capital Markets Technology Advisor will partner with Traders and Regional Sales Directors to provide clients with the subject matter expertise that has become the foundation to the MCT client experience. Your skills as a capital markets expert and technology advisor will further enhance the sales and client retention process.

Essential Functions

The Senior Capital Markets Technology Advisor has platform experience and can tailor an explanation of its benefits, differentiators, and functionality to the listener. From C-Suite decision makers to Secondary Marketing Managers, the Senior Capital Markets Advisor cultivates rapport and trust through demonstrated capital markets and platform expertise. Across MCT’s sales regions, the Senior Capital Markets Technology Advisor will work with Regional Sales Directors to educate, enlighten, and elevate prospects and clients throughout their journey with MCT.

Specifically, Senior Capital Markets Technology Advisor is on point to deliver the following:

- Demo the MCTlive! platform during the sales process

- Drive the on-boarding process for new clients onto the MCTlive! platform, including data normalization and mapping

- Act as main point of contact for clients who have chosen to use our platform autonomously

- Partner with traders and other MCT team members to deliver technical advice for clients who have selected MCT support with our platform

- Capture and share salient user feedback on potential enhancements and/or new functionality

- Help QC aspects of in-development enhancements and new functionality

- Actively assist in all CSG support functions

Qualifications

- Proven ability to work well under pressure situations and flexible in adapting and responding to changing conditions situations.

- Ability to work independently, is an effective team player, committed to results; solutions oriented; superior organizational skills.

- Excellent written and verbal communication skills – ability to present, train, influence and negotiate.

- Self-starter and critical thinker.

- Demonstrate ability to communicate, present and influence key stakeholders at all levels of an organization, including Executive and C-level

Required Education and Experience

- BA/BS degree in Business, Finance, Accounting or related field and/or equivalent experience

- 10+ years Mortgage Secondary Marketing experience

- 5-7 years of Hedging/Trading experience

- 3+ years of experience using the MCTlive! platform

Senior CMTA - Investor Solutions ($100-150K per year)

JOB DESCRIPTION

The Investor Solutions Capital Markets Technology Advisor is a high impact role within MCT’s Investor Solutions Group. Reporting to the Head of Investor Solutions, the Investor Solutions Capital Markets Technology Advisor (CMTA) will work with institutional buyers, traders, and investors to ensure our data and technology solutions drive efficient and transparent transactions in the MCT Marketplace. Your skills as a capital markets expert and technology advisor will further enhance the sales and client retention process.

Essential Functions

The Investor Solutions CMTA ideally has platform experience and can tailor an explanation of its benefits, differentiators, and functionality to the listener. From C-Suite decision makers, Capital Markets Managers and Secondary Marketing Managers, the Investor Solutions CMTA cultivates rapport and trust through demonstrated capital markets and platform expertise. The Investor Solutions CMTA will work with Investor Solutions Sales Directors to educate, enlighten, and elevate prospects and clients throughout their journey with MCT.

Specifically, Investor Solutions CMTA is on point to deliver the following:

- Demo Investor Solutions products on the MCTlive! platform during the sales process

- Drive the on-boarding process for new clients, including data normalization, mapping, and execution setup

- Act as main point of contact for investor clients to answer questions and troubleshoot issues

- Capture and share salient user feedback on potential enhancements and/or new functionality

- Help QC aspects of in-development enhancements and new functionality

- Actively assist in all ISG support functions

Qualifications

- Proven ability to work well under pressure situations and flexible in adapting and responding to changing market conditions.

- Ability to work independently, is an effective team player, committed to results; solutions oriented; superior organizational skills and attention to detail.

- Excellent written and verbal communication skills – ability to present, train, influence and negotiate.

- Self-starter and critical thinker.

Required Education and Experience

- BA/BS degree in Business Administration, Sales, or related field and/or equivalent experience

- At least 5-7 years of capital markets experience, especially with pricing and pooling

- Experience using the MCTlive! platform preferred

- 10+ plus years of secondary markets experience

Junior Trader (Starting at $25 per hour)

JOB DESCRIPTION

As a Junior Trader at MCT, you will play a vital role in supporting our clients’ secondary marketing operations within the mortgage capital markets space. You’ll monitor client pipeline positions in real-time using our proprietary MCTlive! platform, execute trades to maintain appropriate coverage ratios, review pipeline data for accuracy, analyze Mark-to-Market reports, and compile Best Execution analyses for clients. Your responsibilities also include processing LOS writebacks and answering client calls promptly, all while staying informed of market-moving events that could impact mortgage rates and securities pricing.

This position requires you to work collaboratively across various MCT divisions including lock desk operations, MSR valuation teams, and data integration specialists to ensure comprehensive client service. You’ll communicate directly with clients to explain complex market dynamics, commit loans based on Best Ex findings, and provide feedback to internal teams on execution pricing. This role offers an excellent entry point into mortgage capital markets with significant growth potential as you develop expertise in secondary marketing, trading operations, and client relationship management.

Key Responsibilities

- Monitor clients’ open pipeline positions and adjust coverage accordingly in MCTlive!

- Execute trades on behalf of clients to maintain appropriate coverage levels (via TAM or phone)

- Review pipeline data to identify and address errors or inaccuracies

- Analyze Mark-to-Market reports for consistency and escalate potential issues to Traders and Team Leads

- Compile clients’ Best Ex data, communicate findings to clients, and commit loans accordingly

- Review non-bid executions for pricing accuracy and provide professional feedback to internal teams

- Process LOS writeback at clients’ request (when proper integration exists)

- Collaborate with all internal MCT divisions (lock desk, MSR, data integration, etc.) to ensure cohesive client coverage

- Stay informed of market-moving events

- Maintain proficiency with MCTlive! features and functionality

- Answer incoming phone calls promptly

Qualifications

- Bachelor’s degree in Finance, Economics, or related field preferred

- Strong analytical skills and attention to detail

- Excellent communication abilities (written and verbal)

- Ability to work in a fast-paced environment and manage multiple priorities

- Basic understanding of secondary mortgage markets preferred

- Proficient in Microsoft Office suite

- Customer service orientation with problem-solving mindset

- Ability to learn new software systems quickly

What We Offer

- Comprehensive training on MCT systems and mortgage capital markets

- Collaborative team environment with mentorship opportunities

- Career growth path to Senior Trader positions

- Competitive compensation and benefits package

Apply for a Career at MCT

"*" indicates required fields