Treasury yields plunged last week amid fears that the fast-spreading coronavirus would disrupt global trade and economic activity. With U.S. equities off by about 2.5%, the 10-year yield dropped by almost 18 basis points to end the week at 1.508%, breaching its early October lows and getting within 5 basis points of the late-summer trough. While yields for coupon-paying securities declined pretty much in unison, Treasury bill rates actually rose slightly, leaving the 3mo/10-year spread slightly inverted even though the 2/10-year spread closed roughly unchanged. Despite the Fed’s fairly neutral statement after their Open Markets Committee meeting on the 29th, the Fed Funds futures market is currently projecting a 25 basis point rate cut by as early as the June or July meetings, and two easings by the end of 2020.

*The MBS Weekly Market Profile Report corresponds to the commentary below.*

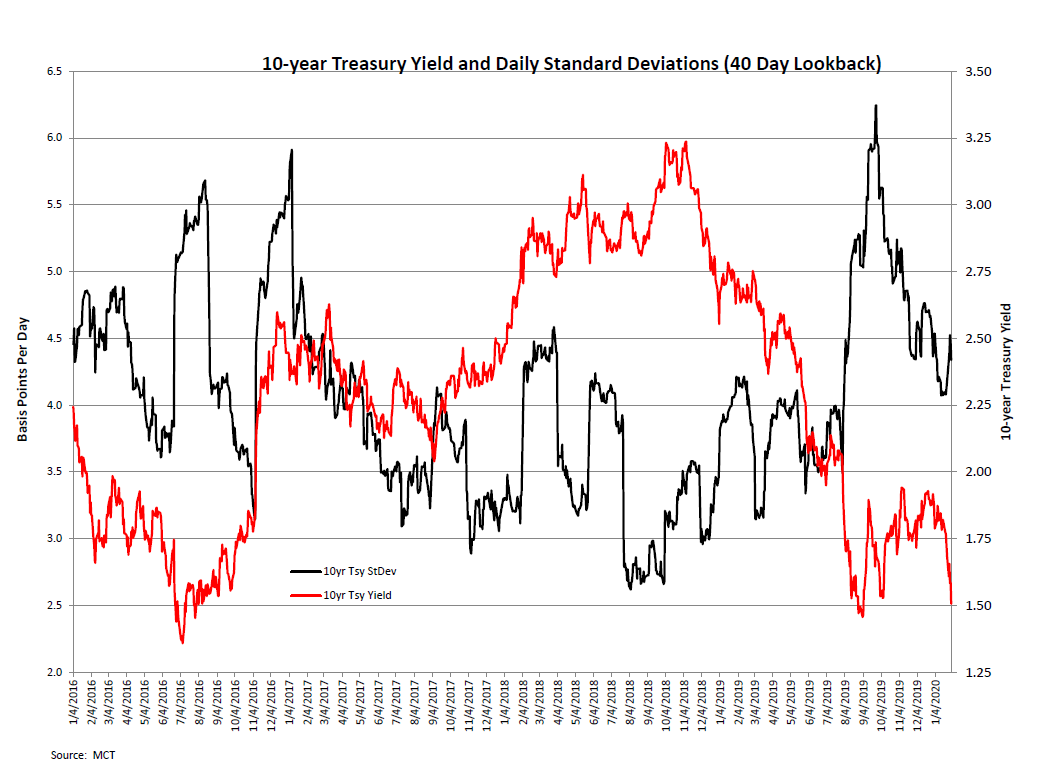

A look at the TIPS market gives some further insights into last week’s rally. While the 10-year TIPS breakeven rate (i.e., the spread between the cash and TIPS yields, and a proxy for expected inflation) declined by about 4 basis points, the TIPS yield itself (a surrogate for “real” long-term rates) dropped by 13.5 basis points to yield -0.133%, its first sub-0% print since late August. This suggests that the rally has been driven by expectations for slower long-term growth and capital costs and is not a reflection of sharply declining inflation fears. The rally also abruptly ended the trend of declining realized volatility. The chart below indicates that the 40-day standard deviation of daily yield changes, which had been dropping steadily since late September, bottomed out in the middle of January and has since increased by about ½ basis point per day.

MBS have struggled amid the drop in rates and uptick in volatility. The 30-year conventional current coupon spread over Treasuries widened by about 8 basis points, while the Ginnie current coupon spread widened by 10 bps. Dollar roll specials have pretty much disappeared, with only the Ginnie II 3% rolls trading a tick or more better than their economic levels. Coupon swaps also contracted, highlighted by the UM30 and GNII 3/2.5 swaps declining by 7-8 ticks. While the weakness in coupon swaps is typical in a rally, an interesting development was the decline in Ginnie/UM swaps, which narrowed by 5-8 ticks. (Also notable was the inversion of the GNII/UM30 3.5 swap, which dropped a quarter-point to end the week at -4/32s.)

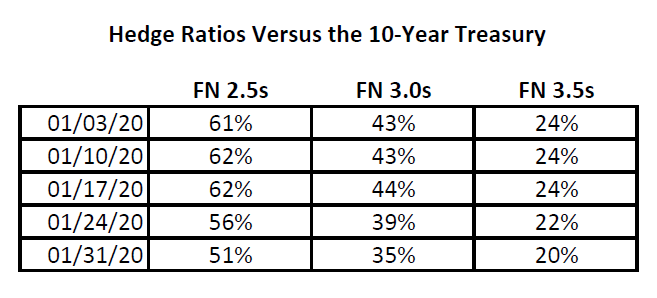

A notable development in the rally was the decline in MBS durations and hedge ratios resulting from faster expected prepayment speeds. This is a textbook representation of “negative convexity,” which reflects the rate of change of duration, which in turn is the rate of change in a bond’s price given some change in yield. (If you view duration as akin to “speed,” convexity is equivalent to “acceleration.”) The accompanying table shows the hedge ratios to the 10-year Treasury calculated from Bloomberg’s model for every Friday in January for UM30 liquid coupons, and indicates that the 10-year hedge ratios for UM30 2.5s and 3s declined by 10% and 8%, respectively.

The figures illustrate the challenges of managing and hedging a portfolio containing mortgages and/or MBS. In addition, they highlight how declining MBS durations in a rally can trigger more buying by portfolio managers looking to maintain portfolio durations, putting additional downward pressure on rates.

About the Author: Bill Berliner

As Director of Analytics, Bill Berliner is tasked with developing new products and services, enhancing existing solutions, and helping to expand MCT’s footprint as the preeminent industry-leader in secondary marketing capabilities for lenders.

Mr. Berliner boasts more than 30 years of experience in a variety of areas within secondary marketing. He is a seasoned financial professional with extensive knowledge working with fixed income trading and structuring, research and analysis, risk management, and esoteric asset valuation.

Mr. Berliner has also written extensively on mortgages, MBS, and the capital markets. He is the co-author, with Frank Fabozzi and Anand Bhattacharya, of Mortgage-Backed Securities: Products, Structuring, and Analytical Techniques, which was named one of the top ten finance texts in 2007 by RiskBooks. He wrote and edited chapters for The Handbook of Mortgage-Backed Securities, The Handbook of Fixed-Income Securities, Securities Finance, and The Encyclopedia of Financial Models. In addition, Mr. Berliner co-authored papers published in The Journal of Structured Finance and American Securitization. He also wrote the monthly “In My View” column for Asset Securitization Report from 2008-2012.