Treasury yields saw subtle gains through last week. The 30-year yield increase from 1.42% to 1.45%, and the 10-year edged up to 0.70%. The 10-year TIPS yield remains at -0.97%.

Mortgage rates are also low and relatively unchanged. MBA data shows an average 30-year fixed rate of 3.07%. The MBA’s mortgage applications index fell by 2.5% in the week ending September 11th, after rising 2.9% in prior week. Purchases are down .5% after rising 3.7%, and refis are down 3.7% after rising 3% last week.

MBS had tough week relative to Treasury benchmarks. The Fannie 30-year 2, 2.5, and 3 coupon underperformed the 10-year Treasury by 6-10 ticks in a 5-day cumulative relative performance measure. Higher Fannie coupons underperformed by 4-5 ticks, exhibiting a moderate down-in-coupon bias toward underperformance. Ginnies fared slightly worse as low coupons underperformed by 12-16 ticks and higher coupons lagged by 6-9 ticks. Fannie 15-years weakened as well with coupons ending the week 11-13 ticks behind the 5-year Treasury benchmark.

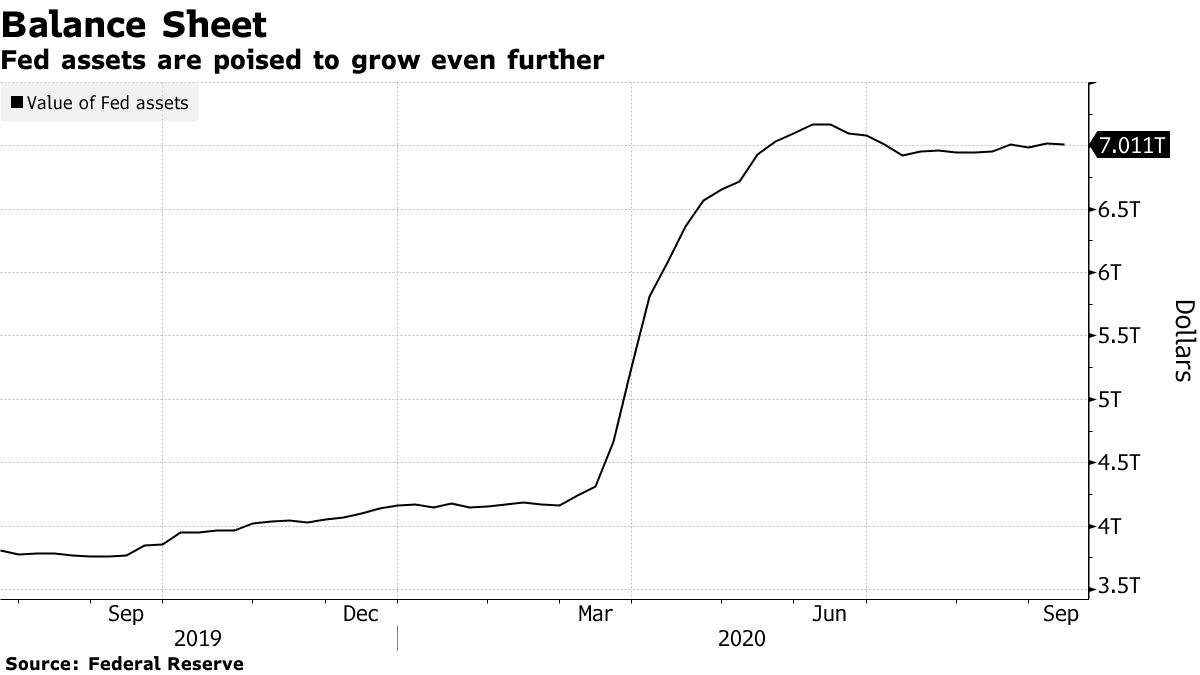

On Wednesday, the FOMC announced their plan to continue holding interest rates near zero until the labor market reaches maximum employment and inflation averages the 2% target. Further, policy makers predict the Federal Funds rate to remain unchanged until the end of 2023. Without the ability to lower interest rates any further, the Fed is limited to relying on their own purchase activity to support the housing market. The Fed plans to carry on purchases of Agency MBS in quantities at least as great as the period prior – that means at least $111 billion until October 15th.

See the chart below displaying the Fed’s current assets.

Fortunately for lenders, the Fed’s insatiable appetite for MBS has continued to keep interests rates low. In fact, rates would likely drift even lower if lenders were not already handling as much volume as they can possibly process. As volume decreases due to seasonal slowing and lenders resume pricing in the FHFA’s adverse market fee, we may begin to see rates creep lower again. However, pent-up demand from delayed purchases (due to COVID) may serve to offset volumes from traditionally slowing in the winter.

This week’s mortgage-related economic calendar includes existing home sales on Tuesday, MBA mortgage applications, FHFA price index on Wednesday, and new home sales on Thursday.