Long and intermediate Treasury yields edged lower last week as 30-year Treasuries experienced a 10-basis point drop while yield on the 10-year fell by 5bps. The accompanying 2-10 Year spread flattened by 5bps due to the 2-Year yield increasing to .16% on Friday. According to minutes released on Wednesday from the Federal Reserve’s meeting in July, the Fed is not presently considering using yield control to assist as a method of quantitative easing.

Yield control, a monetary policy currently employed by Australia’s central bank and the Bank of Japan, is a variation on quantitative easing where the Fed buys enough securities to cap the yield on a given maturity and thereby fight adverse movements in the yield curve during times of crisis.

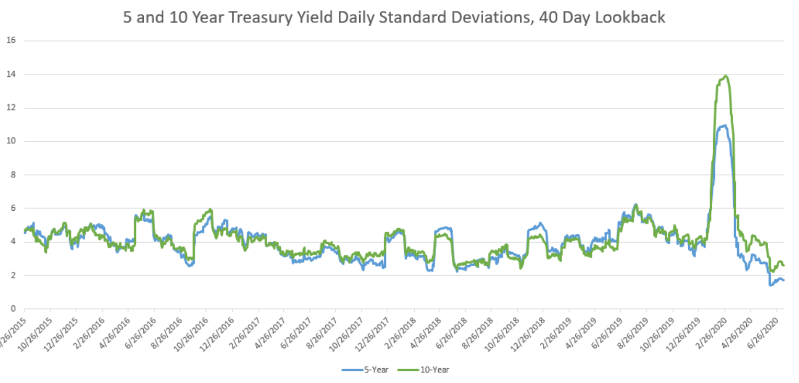

The graph below indicates that the 40-day standard deviation of the 5-year yield is approaching its lowest level in years, only a few months after the pandemic-related market disruptions took the note’s volatility to levels last seen during the financial crisis of 2008-10.

MBS hedge ratio adjusted performance (relative to Treasuries) remained stable last week as the price on the Fannie 30-year 2 coupon topped out at 103-08+ on 8/17 and prevailed at that level the rest of the week.MBS 5-day cumulative duration-adjusted performance relative to 10-yr and 5-year Treasury notes was also relatively flat on higher coupons. Most notably, the Ginnie 3 coupon fell by about 9 ticks in its 5-day cumulative spread over the 10-year. The drop in performance on the 3 is likely linked to the increased volume and thereby liquidity of the Ginnie 2 coupon in the TBA market, which is now much more widely in use to hedge lower coupon government production. Also noteworthy, Ginnie 2 coupon trading accounted for slightly over 15% of total Ginnie TBA trading on Friday, and the Fed added the Ginnie 2 security to their MBS purchases for the first time last week.

The graph below demonstrates the rally we continue to see on the Fannie 2 coupon in the TBA market.

Primary mortgage rates have begun to float higher in an expected positive correlation between interest rates on new originations and the FHFA’s 50bp refinance tax. Freddie Mac’s Primary Mortgage Market Survey has the 30-Year fixed rate at 2.99% for the week ending on 8/20. Since Freddie’s lowest ever recorded average prime-rate of 2.88% on 8/6, prime rates have increased 3bps in the last week and 11bps over the last 2 weeks. Increasing rates have slowed new mortgage applications and especially hampered refinances according to data provided by the MBA’s Weekly Application Index. Total applications are down 3.8% and refi’s are down 5.3% week over week.

Financial repercussions of the Covid-19 pandemic continue to surface as data provided by one servicing vendor show delinquencies falling to 9% from June, although they are still over 100% higher than they were last year. Their data also suggests that early-stage delinquencies, loans with a single missed payment, have declined lower than pre-covid levels. However, serious delinquencies, those 90 days or more delinquent, have risen to 1.8 million above their pre-covid levels. For government loans, serious delinquencies can affect the performance of the mortgage-backed security for the bondholder. Ginnie regulations allow 90-day delinquent loans to be bought out of pools at par, negatively impacting the bond’s yield. Banks have already bought upwards of $19 billion in delinquent loans out of pools in July and August and it is reasonable to expect that this activity will continue if serious delinquencies continue to trend upward.