Paul’s Tip of the Week:

Fannie Mae Purchase Advice API

Published on 04/28/2022

MCT’s award-winning capital markets platform, MCTlive!, is now integrated with the Fannie Mae Connect™ Whole Loan Purchase Advice Seller API. Learn to connect the API in this tip of the week.

Paul's Tip of the Week

MCT recently completed the first integration to Fannie Mae’s new API for loan sale purchase advices. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Fannie Mae purchase data instantly, instead of waiting to run reports through a Loan Origination System (LOS). The integration also allows MCTlive’s Loan Commitment Tracker to automatically draw down outstanding commitments as loans are purchased by Fannie Mae.

Downloading and manually entering purchase advice data was one of the last remaining labor-intensive processes for lenders required after each loan sale, and this API closes the loop on performance reporting. MCT is in the process of working with many whole loan buyers to automate the delivery of their purchase advices into MCTlive! MCT can be contacted to start the process of automating purchase advices for whole loan buyers or sellers.

Contact the Client Services Group (csg@mctrade.net) or your trader to get this set up.

This can be added to your current Fannie PE Wholeloan ID or you can create a new ID. Your Fannie Corp Admin should be able to complete this task in Fannie’s Technology Manager.

Use this link discussing the steps to add this Application.

To set up the API, follow the below instructions:

- Email csg@mctrade.net requesting access to the Purchase Advice Center tab in MCTlive!

- Login to MCTlive using this link https://www.mctlive.com/beta/centralanalyzer/login.php

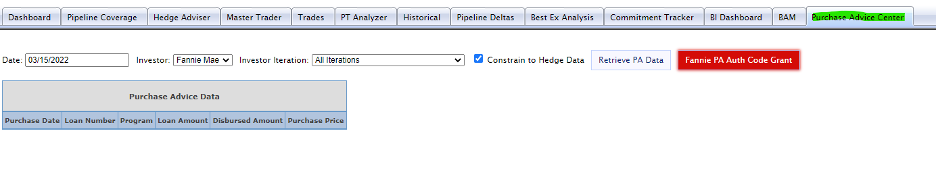

- Click the Purchase Advice Center tab

Step 3:

MCTlive’s first Purchase Advice integration with Fannie Mae allows a user to pull PA information for any given date, straight from Fannie Mae. This allows quicker access to the information and a more streamlined process to update critical reports that can effect a lender’s P&L and hedge accounting reports.

Having previously been a Secondary Marketing Manager, I know that recording and updating purchase advice data is a task that is time consuming but necessary. MCTlive’s Purchase Advice integration with Fannie Mae makes this process so much more efficient by allowing our clients to customize how the data is exported to their LOS and providing the ability to do bulk purchase advice updates. That in and of itself streamlines the process. I would have loved to have this feature when working in secondary!

About MCTlive! – Pipeline Management Software

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- Bid Auction Manager (BAM) Loan Trading Platform

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

About the Author

Paul Yarbrough, Director of Client Success Group

Secondary marketing expert Paul Yarbrough joined San Diego-based MCT to oversee new client on-boarding, manage the company’s secondary marketing technology and implement necessary solution training.

He has detailed knowledge on how to leverage secondary marketing technology to proficiently run capital markets functions. He plays an important role in implementing and training lenders on MCT’s secondary marketing technology platform MCTlive!, as well as ancillary solutions. Mr. Yarbrough has a BA in Finance from West Texas A&M with a minor in Economics.