2024 is in full swing and MCT experts are here to inform, predict, and guide you through all of your most pressing 2024 housing market questions. In this blog, MCT will help you gain clarity and clear up future predictions for the remainder of 2024 and 2025 in regard to the most important topics in the housing market right now.

Housing Market 2024 Overview

Will the housing market crash in 2024? Are house prices going down in 2024? Will mortgage rates go down in 2024? Read this market predictions for 2024 Q2 article to learn our analysis for the rest of 2024 and predictions for the 2025 housing market.

The prediction for interest rates for the remainder of 2024 is that mortgage rates will continue to rise. Let’s explore potential outcomes as we dive deeper into the year!

Although there are certain factors that can point to a possible market crash happening in our society right now, experts do not currently expect a housing market crash.

Factors such as low inventory, strict lending standards, and other market conditions suggest that a crash is not imminent. These factors contribute to a more stable housing market outlook.

The main concern that individuals have on a potential market crash are due to a rise in interest rates, a surge in foreclosures, a decline in population growth, and supply and demand changes. That being said, MCT is here to set the record straight on these topics to clear up any confusion on how they contribute to a market crash in 2024 or the near future.

One significant factor is a sharp rise in interest rates, which can make it more expensive for homebuyers to borrow money and thus reduce demand for homes. Another factor is a surge in foreclosures, which can flood the market with distressed properties and lower housing prices.

Additionally, a decline in population growth or migration can decrease the demand for housing, potentially leading to a market crash.

Speculative bubbles, driven by excessive demand and exuberance, can also contribute to a housing market crash. “You’re not going to see house prices decline,” says Rick Arvielo, head of mortgage firm New American Funding. “There’s just not enough inventory.”

Skylar Olsen, chief economist at Zillow, doubles down about the imbalance of supply-and-demand as she predicts home prices to rise in 2024, “We’re not in that space where things are suddenly going to be more affordable.” Not great news for first-time home buyers. That being said, there are still far more buyers than sellers even with this negative first-time homebuyer news, meaning that there will not be a market crash likely.

According to MCT housing market experts and other experts in the field, the likelihood of a housing market crash in 2024 is low. Overall, while there are factors that could potentially lead to a housing market crash, the current market conditions point towards a more stable situation. The interplay between supply and demand, as well as economic and interest rate fluctuations, will continue to shape the housing market in the future. While there may be localized price declines and bubble-like characteristics, the overall market remains stable and resilient.

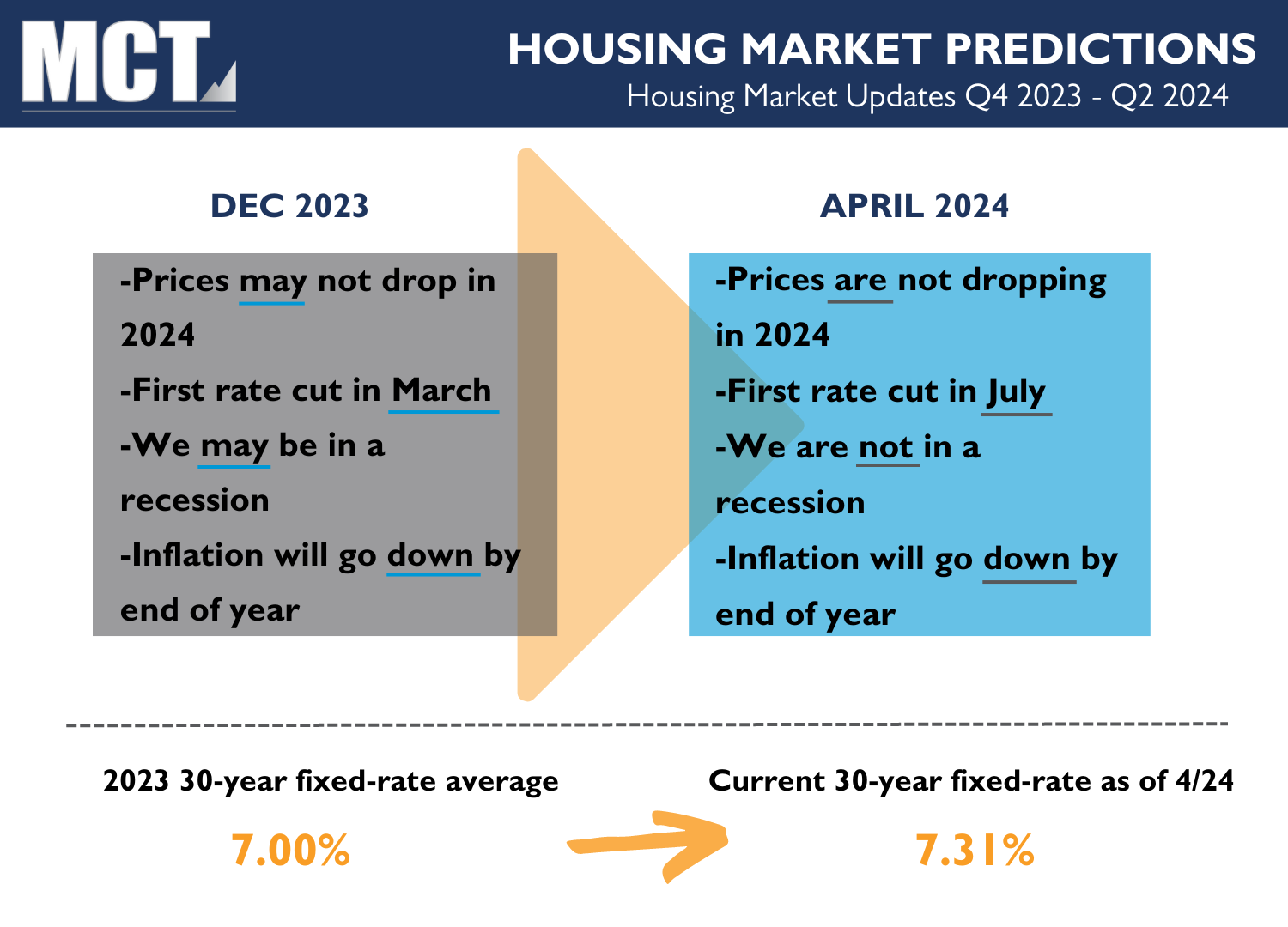

The general consensus is that housing prices will not be dropping in 2024. The majority of forecasts indicate that house prices in the US are expected to rise or remain stable in 2024.

The housing market is influenced by various factors such as supply and demand dynamics, economic conditions, government policies, and local market conditions. While there are projections and forecasts available, the accuracy of these predictions can vary. Based on the trends we are seeing from last year, at least staying stagnant is something to celebrate.

Based on the available data, there are mixed forecasts and trends regarding the potential decrease in house prices in the US in 2024. Wells Fargo analysts predict a rise of 2.5% in US home prices in 2024. However, HousingWire‘s lead analyst, Logan Mohtashami, predicts a more modest rise of 2.33% in 2024. Freddie Mac, on the other hand, has made quite the switch from a negative outlook to a more hopeful prediction; It originally predicted a 2.5% raise in 2024 and a 2.1% raise in 2025. Now, it are stating that prices will increase only 0.5% in 2024 and 2025.

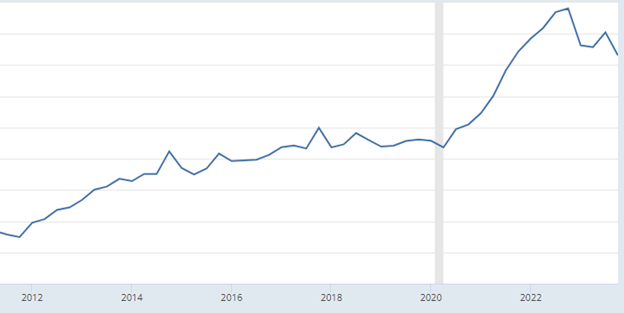

The median home-sale price as of February 2024 was $384,500, representing a 5.7% increase from the previous year according to NAR data. Additionally, home prices nationwide, including distressed sales, increased by 5.5% in December 2023 compared to the previous year. These data points suggest a continued upward trend in home prices.

However, it is important to note that there could be indications of potential stabilization or slight decreases in home prices based on where interest rates are headed. The average 30-year fixed mortgage rate in 2024 remains above 6%, although down from its 2023 high of 7.79%. This could potentially impact the demand for homes and influence prices, though rates my rise in 2024. Furthermore, the National Association of Realtors reports a 0.8% year-over-year decrease in home prices through December 20235. While this decrease is relatively small, it may indicate a possible trend towards stabilization or a slight decline in home prices.

In conclusion, while there are differing predictions, the majority of forecasts indicate that house prices in the US are expected to rise or remain stable in 2024. While there may be some markets where home prices continue to rise, the overall trend indicates a potential stabilization, though it is not entirely definite.

Some economists have revised their rate predictions, anticipating them to be higher this year than previously thought.

According to Forbes Advisors, the average 30-year fixed-rate mortgage was 6.88% as of April 11, 2024. However, on April 18, the rate jumped to 7.10%, according to Freddie Mac. Another source from Bankrate states that on April 24, the current average 30-year fixed mortgage interest rate was 7.29%. These fluctuations indicate that mortgage rates have been on the rise in recent weeks.

%

30-Year Fixed Rate as of April 24, 2024

Fannie Mae has revised its outlook and now expects 30-year mortgage rates to be at 6.4 percent by the end of 2024, compared to an earlier forecast of 5.8 percent.

Contrary to the hopes of potential homebuyers, mortgage rates are expected to go up rather than down in 2024.

There are many factors that go into how the conclusions are created. While it is not an exact science, conclusions can be brought about my several notable factors, including the overall health of the economy, inflation rates, monetary policies, and market conditions.

The Federal Reserve plays a significant role in shaping mortgage rates. It has been signaling a gradual increase in interest rates over time to combat inflation and promote economic stability. As a result, mortgage rates have already been slowly rising over the past couple of years.

Additionally, the US economy has been performing relatively well, with low unemployment rates and steady economic growth. When the economy is strong, it often leads to higher demand for loans, including mortgages. This increased demand can put upward pressure on interest rates.

Furthermore, the housing market itself has been experiencing high demand and limited supply in many areas, which typically leads to higher home prices. When home prices rise, lenders may increase mortgage rates to offset the increased risk associated with larger loan amounts.

Considering these factors, it is reasonable to assume that mortgage rates are more likely to remain stable or even increase in the near future, rather than dropping significantly. However, it is important to note that predictions regarding mortgage rates are subject to uncertainty and can be influenced by various unforeseen events or changes in economic conditions.

No. The US economy, though experiencing hardships in the housing industry and inflation, is not in a recession according to the definition of recession.

To determine if the US is in a recession or if a recession is on the horizon, one must determine what contributes to a recession.

An economic recession is a significant decline in economic activity, typically characterized by a decrease in GDP (Gross Domestic Product), income, employment, and trade. It is a period of economic contraction that lasts for several months or even years. Key indicators of a recession include:

- GDP Growth Rate: If the GDP growth rate is negative for two consecutive quarters or more, it is generally considered an indication of an economic recession.

- Unemployment Rate: A significant rise in the unemployment rate suggests a recession, as businesses reduce their workforce during economic downturns.

- Consumer Spending: A significant decrease in consumer spending, especially on non-essential purchases, can indicate an economic recession.

- Business Investments: A decline in business investments, reflected in reduced capital expenditure and business confidence surveys, can signal a recessionary environment.

Consumer debt rose to $17.5 Trillion (a $212B influx) in Q4 of 2023, the 30-year fixed is at 7.21%, and GDP, though rising, is rising slowly. These don’t give a lot of confidence to consumers, but is it enough to say we are in a recession or that a recession is on the horizon?

That being said, while economic growth has gone down slightly, unemployment remains below 4% for the 26th consecutive month. This is the longest streak since the 1960s.

Considering these factors and indicators, it is important to note that the U.S. economy has not entered a recession as of the first quarter of 2024. However, experts suggest the possibility of a soft landing or mild recession in 2024. It is crucial to monitor macroeconomic factors such as economic growth, employment, wages, and prices to gain insights into the current state of the economy and potential recession risks.

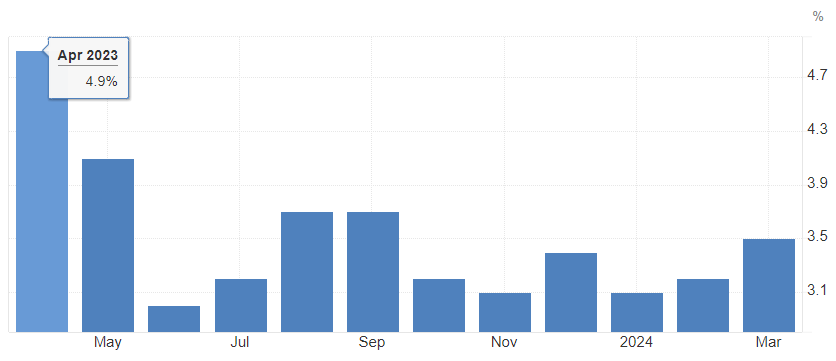

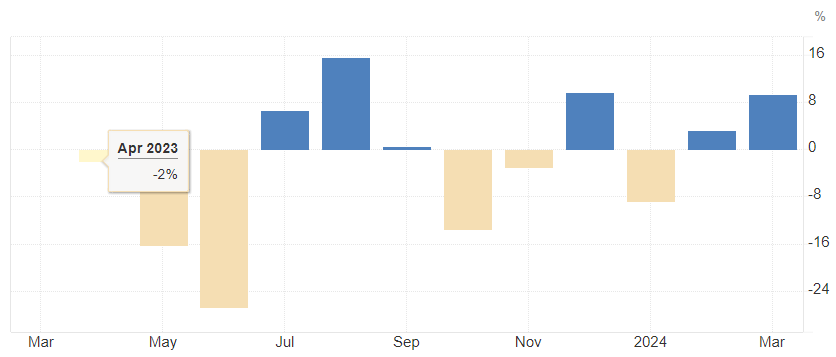

Though it is set to drop, these first few months of 2024 do not look so promising just yet. US inflation, calculated by referring to the Consumer Price Index (CPI), has slowly raised each month from the start of this year – 3.09% in January, 3.15% in February, and 3.5 in March, where we acknowledge we are at currently (April inflation will be available May 15).

This rate is higher than both the inflation rate of 3.15% from last month and the rate of 4.98% from last year. It is also above the long-term average of 3.28%. The current inflation rate of 3.5% (CPI) and the notable rise in prices within a relatively short period of time is considered significant and has implications for the economy.

J.P Morgan’s economists share projects that forecast global core inflation will remain around 3% for rest of 2024, while the ESR Group is now expecting the Consumer Price Index to end 2024 at a 3.1 percent annual rate, compared to the previously projected 2.5 percent.

A recent report from Kiplinger’s economic forecast stated that no progress has been made for the third consecutive month. “Services prices excluding housing rose a strong 0.6%, with car insurance and repair prices both up about 3% on the month” Kiplinger writers state. “This is a key inflation measure the Federal Reserve tracks in order to see whether price momentum is continuing or not.”

The Fed is also not seemingly raising interest rates anytime soon, which impacts inflation. Historically in response to rising prices, the Federal Reserve has been raising interest rates to combat inflation. However, no move is expected in the Fed’s May meeting, and are unlikely to move at the Fed’s June meaning either, meaning that the first interest rate cut for the year is projected to happen a year after the FOMC’s rate hike from July 2023. Our mortgage industry experts all agree that July will be the first interest rate cut. If this is true, it make take longer to see that 2% the Fed has been hinting at, perhaps well into 2025. The Fed’s official report on Friday, April 30 on inflation can give us more guidance to the future.

The US economy entered 2024 on a strong footing, but there are concerns about rising consumer debt and elevated interest rates that could weigh on economic growth, hinting at a slow GDP growth under 1% over Q2 and Q3 2024. This could also therefore impact inflation.

Our unemployment is also very low, which is good, though not necessarily for combating inflation. Low unemployment rates can lead to higher wages and increased consumer spending, potentially causing inflation.

Though with these no-so-promising inflation indicator statistics, experts still believe we are in for a slight cooling.

In summary, various factors influence the current state of inflation in the US economy, including rising consumer debt, elevated interest rates, potential rate cuts, unemployment rates, and GDP growth. While the experts predict lower inflation soon, there isn’t a multitude of information to back that up. Predictions indicate that inflation will reach 3% the near future but we are not likely to see the Fed’s hopeful 2% anytime soon.

United States Inflation Rate May 2023 – March 2024

United States Inflation % Change May 2023 – March 2024

Want to learn more from MCT?

Learn from our secondary marketing experts how you can use hedging as a tactic to mitigate risk and optimize profitability when selling mortgage loans. Fill out the form below to download our latest educational whitepaper!

Download Whitepaper

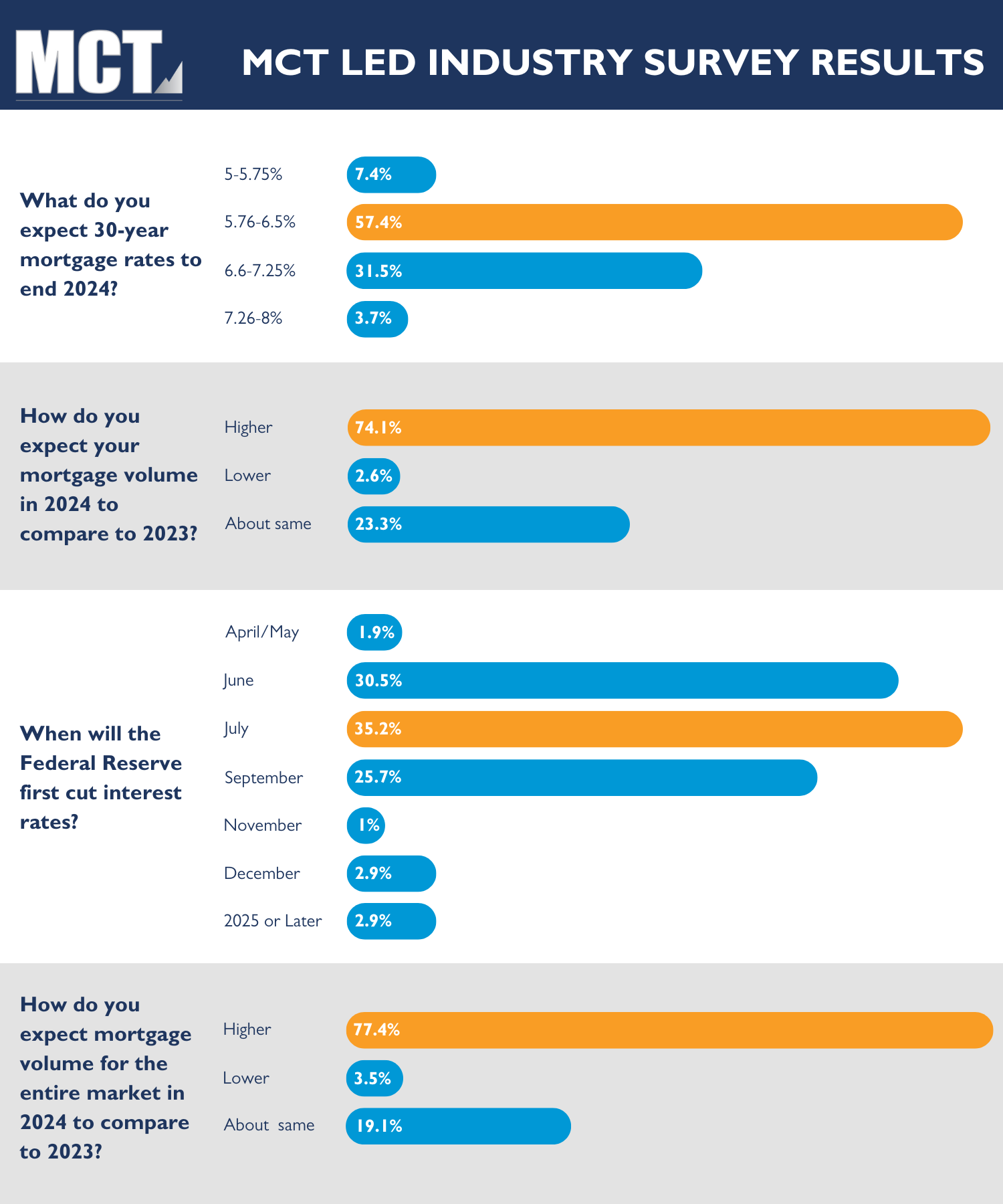

MCT’s very own conducted research based on the opinions and predictions of over 100 capital markets and housing market industry experts shows a real life, unbiased take on the future of the housing market.

What do you expect 30-year mortgage rates to end 2024?

The majority of answerers stated 5.76-6.5%. This is actually in alignment with Fannie Mae‘s most recent outlook as it expects the 30-year mortgage rates to be at 6.4% by the end of 2024.

Something to note is these questions were asked on March 22, 2024; It would be interesting to see how the opinions on this question might fluctuate in accordance with how quickly mortgage rates have been fluctuating in just one month’s time.

How do you expect your mortgage volume in 2024 to compare to 2023?

A hopeful response with an overwhelming 74.1% hopeful of mortgage volume and only 2.6% expecting lower.

When will the Federal Reserve first cut interest rates?

A somewhat of a wavering group opinion shows an almost even tie between June, July, and September: September the lowest of the three at 25.7%, June at 30.5%, and July at 35.2%.

This reflects accurately the opinions stated by others that no move will happen in the Fed’s May meeting or June meeting either.

How do you expect mortgage volume for the entire market in 2024 to compare to 2023?

Another hopeful response seeing that the vast majority of survey participants vote to a higher volume for the entire mortgage market for this year at 77.4%.

Looking ahead, experts predict that home prices will rise more gradually from 2025 through 2028, compared to the substantial surge observed from 2021 through 2023.

While the exact percentage increase is yet to be specified, there is a general consensus that housing prices will continue to experience upward movement. Goldman Sachs, a well-known banking giant, foresees a 3.7% rise in prices by 2025, driven in part by the existing momentum in the housing market. On the contrary, Freddie Mac predicts a modest 0.5% raise for 2025.

In general, the Northeast is set to become increasingly unaffordable, with a projected median home value of $523,017.38 by 2025 and a year-over-year percent growth of 12%. This suggests that housing affordability may become a challenge in this region.

In general, to break the “why” further, the demand for housing is expected to remain high due to population growth, urbanization, and increased migration to key cities. As more people seek housing, the limited supply will drive prices upward. Additionally, the ongoing trend of remote work and flexible schedules may lead to an increase in housing demand in suburban areas, further impacting the overall housing market.

Furthermore, economic factors play a significant role in predicting housing prices. With a positive economic outlook, including stable job growth and low-interest rates, individuals will have the financial means and confidence to invest in real estate. The combination of a strong economy and low borrowing costs stimulates demand and fuels the upward trajectory of housing prices.

Government policies and regulations are also crucial to consider. Policies that promote homeownership, such as tax incentives, subsidies, or relaxed mortgage rules, can stimulate demand and contribute to price increases. On the other hand, stricter regulations or measures to cool down the market might moderate the rate of price growth.

While there are potential risks and uncertainties, such as unexpected economic downturns or policy changes, the overall outlook for housing prices in 2025 remains positive. However, it is important to note that regional variations may occur, and some areas might experience more significant price fluctuations compared to others.

Key Takeaways

- Although there are certain factors that can point to a possible market crash happening in our society right now, experts do not currently expect a housing market crash

- The general consensus is that housing prices will not be dropping in 2024. The majority of forecasts indicate that house prices in the US are expected to rise or remain stable in 2024

- The predictions from various economists suggest that mortgage rates are expected to rise in 2024

- The US economy, though experiencing hardships in the housing industry and inflation, is not in a recession according to the definition of recession

- Inflation is expected to very gradually go down by the end of this year and officially drop to the promised 2% by the Fed in early 2025

- Looking ahead, experts predict that home prices will rise more gradually from 2025 through 2028, compared to the substantial surge observed from 2021 through 2023

Subscribe for More Housing Market Updates

When you join our newsletter you get access to our daily market commentaries.