Our Mission Statement

Fueling the mortgage industry with transformational capital markets technology and personalized client experience.

Our Core Values

Drive to Transform

Harnessing market knowledge and innovative technologies to challenge the status quo and deliver superior results.

Community

Supporting and elevating our clients, partners, MCT team members, and the borrowers whom we all serve.

Trust

Building lasting relationships with knowledge, strong character, and appreciation.

Humility

Achieving mutual success through listening, thoughtfulness, and hard work.

Our top priority is to help you and your company thrive. We’re here to listen, support, and grow your business — together.

Highlights

Over the past 20 years, MCT has evolved from a pipeline hedging services specialist into the industry leader for fully-integrated capital markets software and services. Anchored by our comprehensive platform, MCTlive!, we offer the innovative technology and bespoke client support needed to elevate your performance.

- From MCTlive!, to MSRlive!, to our award-winning MCT Marketplace, MCT is consistently first-to-market with new technology

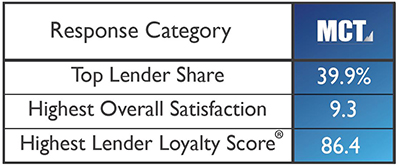

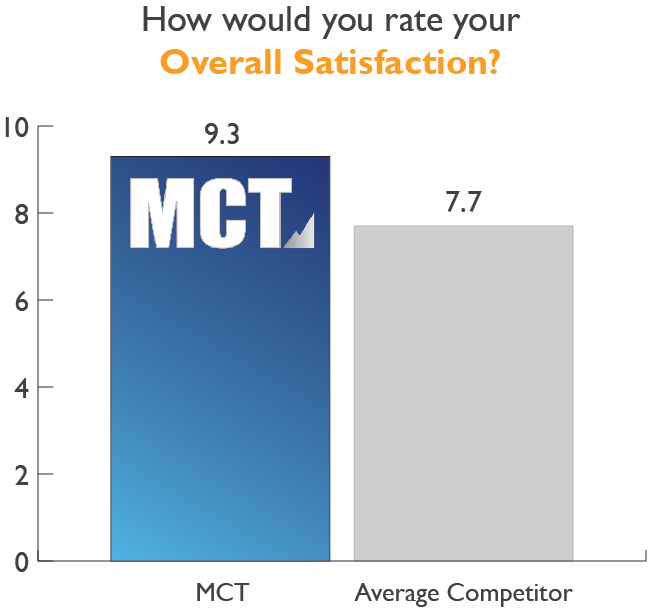

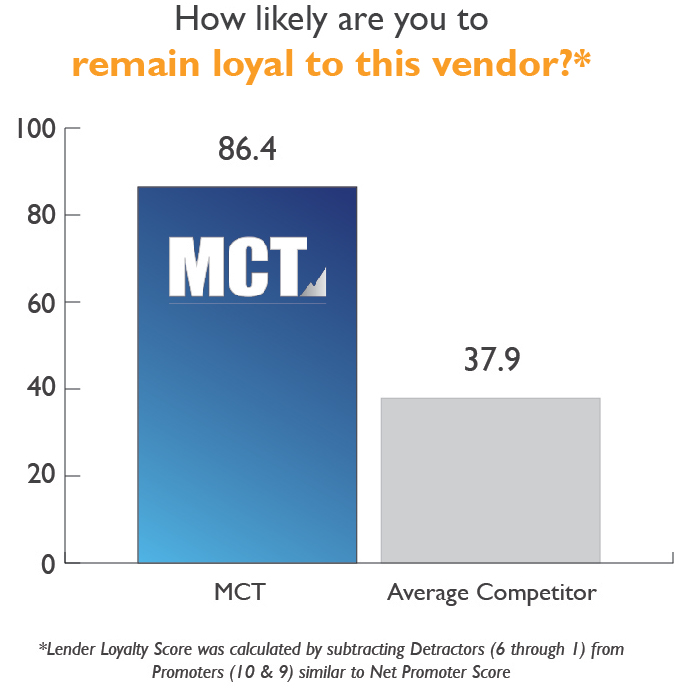

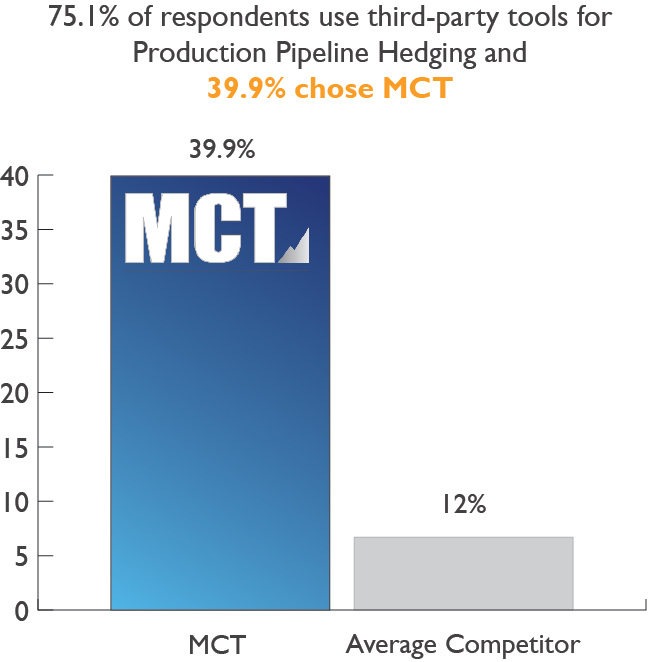

- In 2018 and 2019, independent research firm STRATMOR rated MCT with the highest Lender Loyalty Score in the category of Production Pipeline Hedging. Further, MCT received the highest overall satisfaction of any vendor measured in the study that analyzed the entire mortgage industry.

- At the onset of COVID-19 and while the mortgage industry as a whole was in turmoil, MCT subscribed to “doing whatever it takes” to ensure mortgage lenders (not just MCT clients) remain in business and are positioned to capitalize when the market calms. From further enhancing our mobile offering to launching an entirely new marketplace that creates liquidity during a tight credit market, we responded with insights, action, and results.

Recognized Industry Authority

- MCT works hand in hand with top auditing firms and has authored a series of industry-accepted white papers on accounting best practices

- Consults with the GSE agencies and the US Government on hedging best practices

- MCT staff teaches Secondary Marketing and Servicing Sessions at the School of Mortgage Banking

- Leading participant and expert witness on panels and forums at the MBA, FINRA, and leading regulatory authorities including OCC

- Affinity relationships with the leading GSEs

Compliance & Model Validation

- SOC 1 Type 2 SSAE 18 Audit conducted annually to verify compliance with national and international standards for service organization controls.

- Hedge Model Validation conducted annually to verify compliance with the OCC’s guidelines on Model Validation, Model Risk Management and Mortgage Banking.

Clients have full access to MCT’s Compliance Library

“We are elated to again receive the highest production pipeline hedging scores in STRATMOR’s 2019 Technology Insight Study, which is a direct reflection of how diligently we work to support our clients.”

– Curtis Richins, President of MCT, on the STRATMOR Technology Insight Study 2019, “Production Pipeline Hedging Vendor” Findings